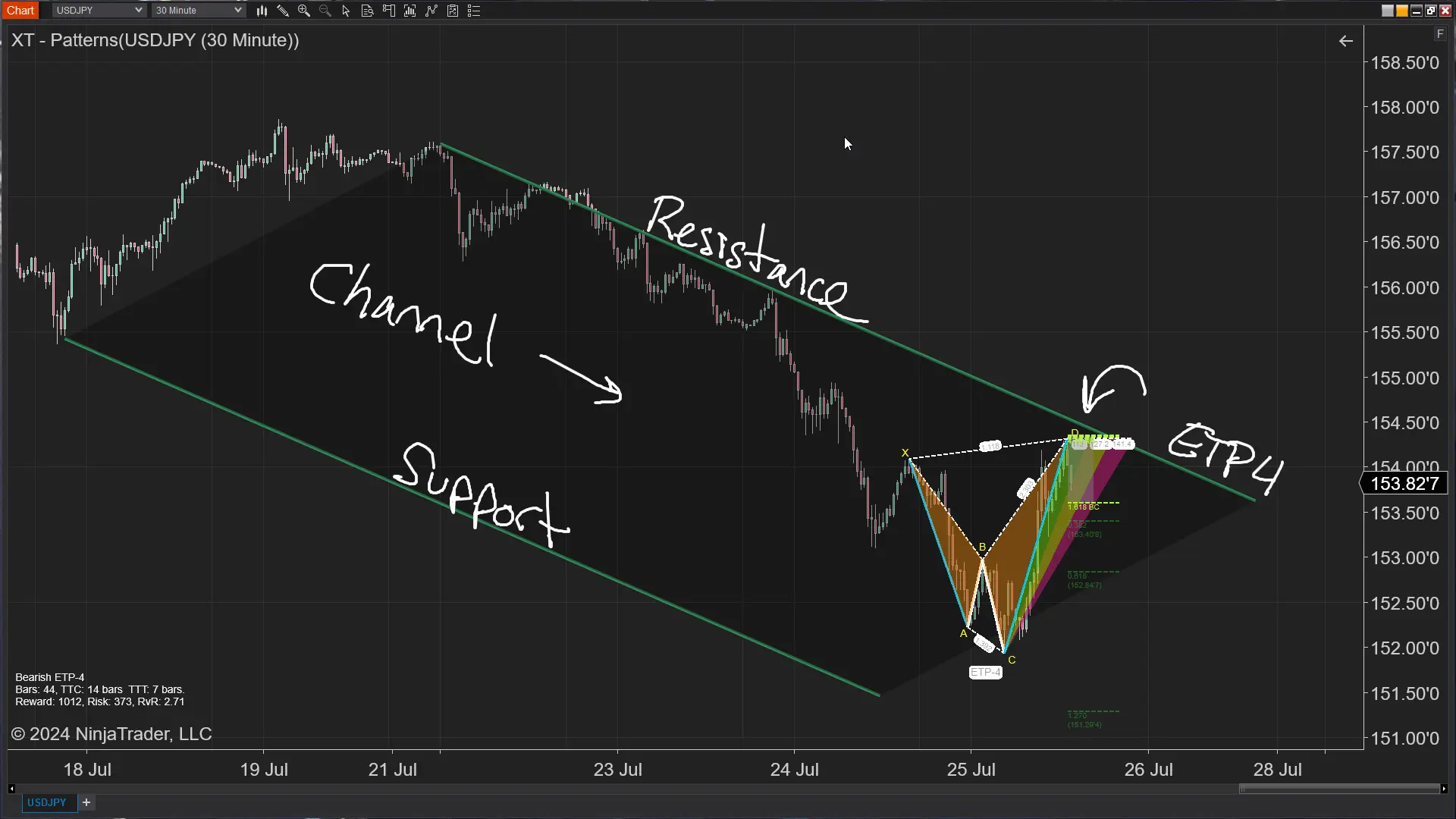

XABCD Trading

Short Term Trading – What You Need To Know

Short Term Trading: The Time Frame You Trade Can Make or Break You

Short term trading does have some key advantages. That doesn't mean it doesn't have their own set of challenges. The time frame you trade could say a lot about you as a person too. Someone who trades a shorter term time frame could have a shorter attention span or they might not want to be exposed to additional risk.

Advantages of Short Term Trading:

The reason you can minimize your exposure in the market is because you're not holding trades for long and thus weekends and holding overnight are not as much of a risk to you. Often times G7, G8 meetings or elections all can take place over a weekend.

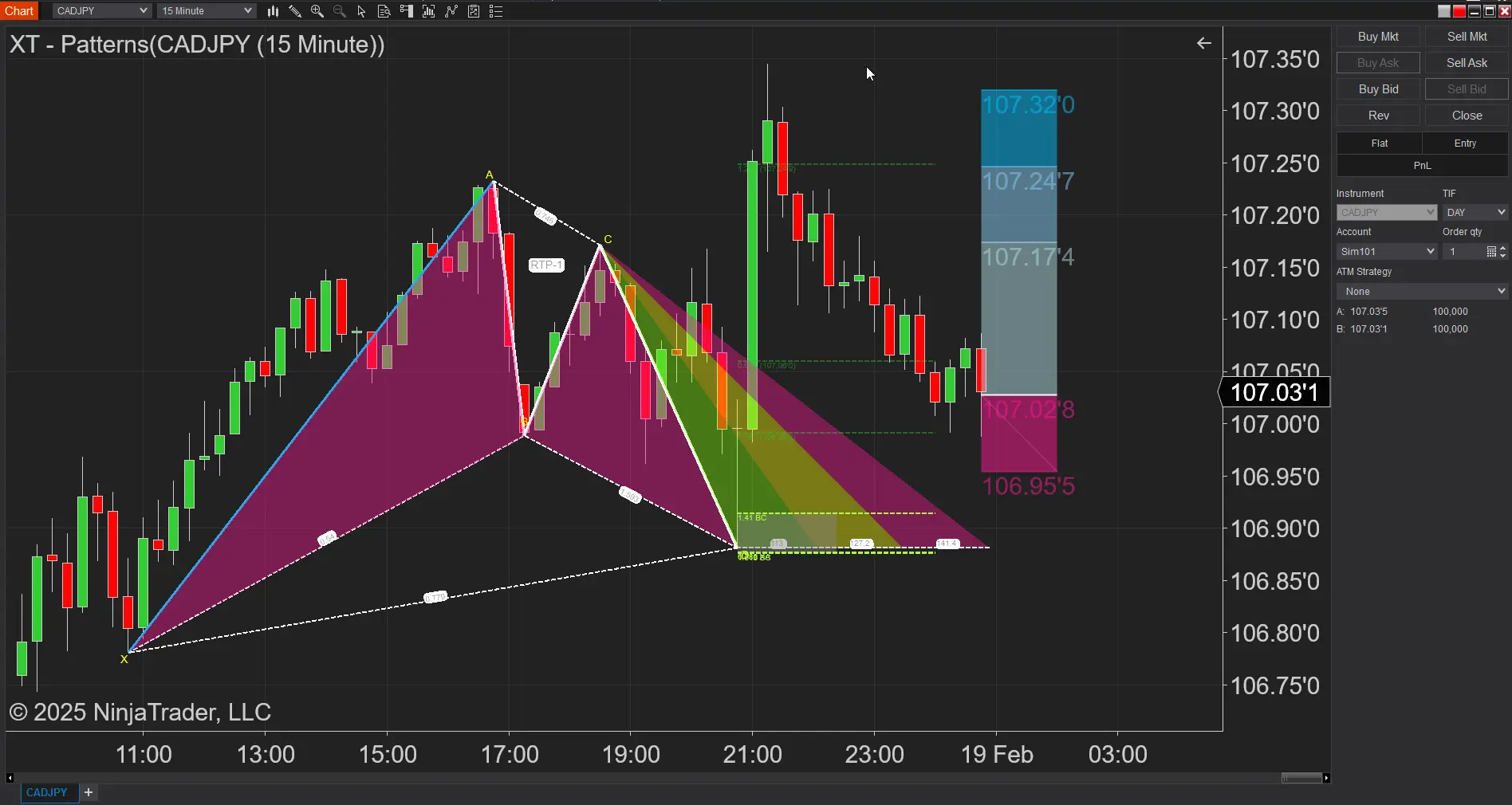

If you get alerted to patterns we scan for in the market you will notice that the 5 minute charts (because there are so many) appear often every 15 to 30 minutes. We've heard from people with a low attention span that this could fit their personality very well.

Disadvantages of Short Term Trading:

Burnout will most probably lead you down a road of poor decisions. Ultimately leading to mistakes and inconsistencies. Of course, this would not apply to everyone but we hear from many people that this eventually happens even if they've been trading for some time. Feel free to share your own experiences in the comments below.

Poor Risk vs Reward: When we talk about quantity of patterns we mostly get poor quality risk vs rewards. You can see that on our pattern statistics page page where you can view the total number of patterns and then look at the RvR (Risk vs Reward) column for each one. There are far less patterns that have a risk vs reward of at least 2:1. That would mean that your reward is twice as big as whatever you are risking.

Are there any we missed?

Better Know Your Plan Cold! When you trade a smaller time frame chart you're going to need to expect yourself to react more quickly. This requires you to know your trading plan cold. There is no room for mistakes because everything from where you get in, to how you reduce your risk and finally map out your trade needs to be known well before you even enter the trade. Nothing can or should shock you. This is totally different than trading a 4-hour pattern where it could be 12 hours before you have to do anything to manage your trade.

We would love to hear from you. Are there any pro's or con's that we missed when trading smaller time frames?

Apr. 06, 2025

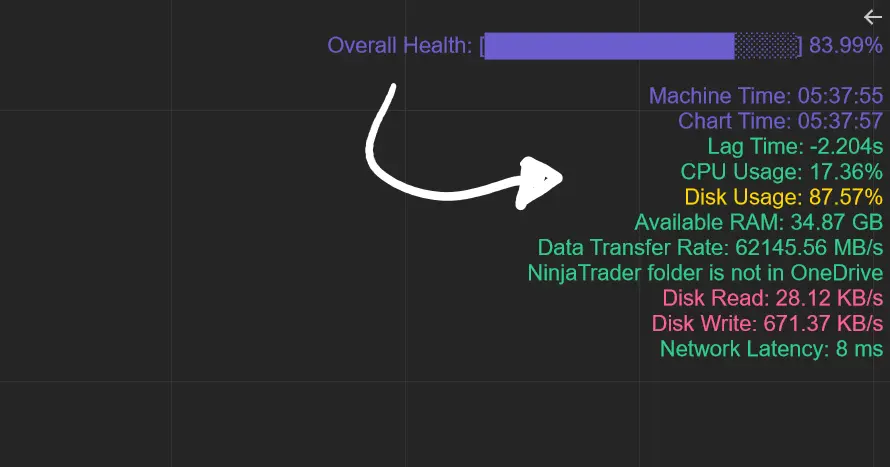

From Lag to Lightning: The Critical Role of Read/Write Speeds in NinjaTrader 8

Mar. 08, 2025

NinjaTrader Margins Requirements for Futures Trading

Mar. 05, 2025

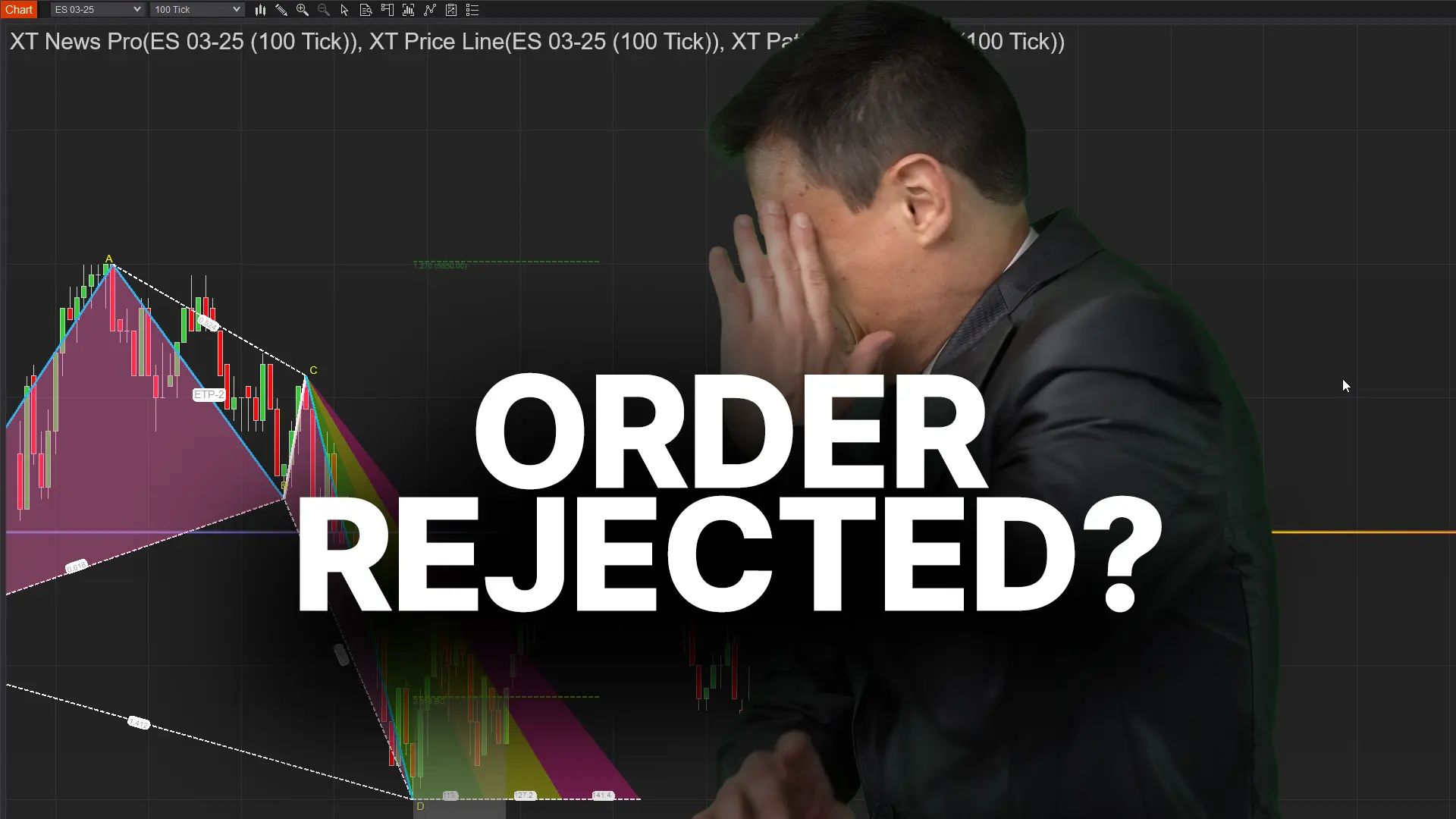

Order Rejected at RMS Meaning in NinjaTrader

Feb. 19, 2025

Boost Your Trading Efficiency: New Automated Order Quantity Feature for Seamless Position Management

Dec. 30, 2024

Are XABCD Patterns Still Useful in 2025?

Nov. 30, 2024

Aligning Time-Based Events with Non-Time-Based Charts for News Events in NinjaTrader 8

Nov. 11, 2024

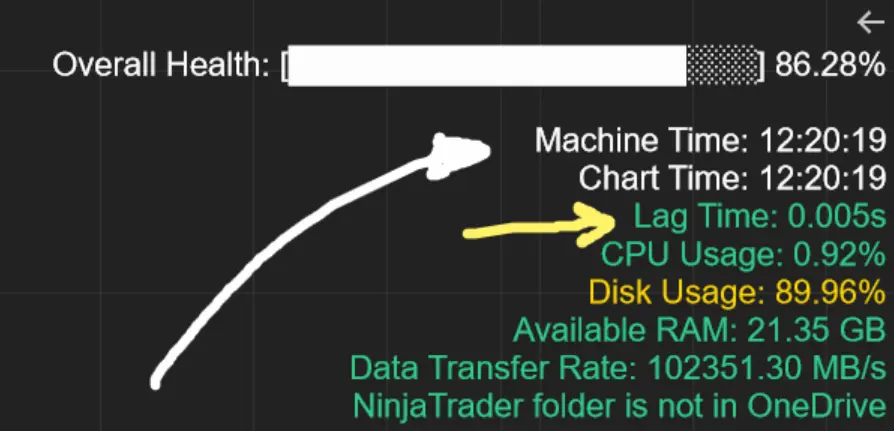

Avoiding Costly Delays: How the XABCD Performance Indicator Identifies Lag Issues in Real-Time

Oct. 26, 2024

NinjaTrader 8 & One Drive Woes? Follow these steps.

Aug. 10, 2024

NinjaTrader and Evaluation Accounts: What You Need to Know

Jul. 25, 2024