XABCD Trading

Boost Your Trading Efficiency: New Automated Order Quantity Feature for Seamless Position Management

If you’re anything like me, you know that trading is as much about smart strategy as it is about quick, precise moves. And let’s be honest—calculating order sizes manually while watching the markets can be a major headache. Especially if you want to be consistent in your approach.

That’s where the new feature in the XABCD Trading Position Tool for NinjaTrader comes in. This little gem automatically updates your order quantity box based on the percentage of risk you’re willing to take, along with your entry and stop loss levels. It’s like having a co-pilot who’s always on point, so you can focus on the trade without worrying about math mistakes.

Why This Tool is a Game-Changer

Keeping It Simple and Error-Free

Ever found yourself double-checking your calculations because you’re not 100% sure if you got it right? Let's be honest, most of you probably don't even do the calculation out of lazyness and might just estimate what 1% or 3% of your account might be worth. Yeah, we’ve all been there. Manual math during those high-pressure moments can lead to mistakes—ones that can seriously mess up your risk management plan. With the XABCD Position tool, you input your risk percentage, entry price, and stop loss, and boom—it instantly spits out the perfect order quantity. This means you’re acting more consistent, without any guesswork involved.

Consistency is Key

If you want more consistent results, you better start acting more consistently. But when you’re busy juggling multiple trades, it’s easy to lose track of your risk management strategy. The XABCD tool keeps things consistent by automating your order size calculations. No more worrying about how many shares or contracts you should be buying—the tool has got it covered every single time. This consistency is huge for building your confidence and ensuring that every trade is on point.

Adapting in Real Time

Markets move fast. One minute, you’re in a steady market, and the next, everything’s shifting. It’s essential to be able to adjust on the fly. With this tool, any changes you make to your entry or stop loss levels are instantly reflected in your order quantity. That way, your trades are always in line with the latest market conditions, which is a massive plus when things get volatile.

Who’s Gonna Love This Tool?

The Solo Trader

If you’re trading on your own, you already know how critical it is to manage risk effectively. The position tool takes the hassle out of figuring out the perfect order size, letting you focus on reading the charts and making smart moves. Especially if you’re just starting out, having an automated system in place helps build those good trading habits right from the start.

Prop Traders: Your New Best Friend

For those trading with prop accounts, the stakes are even higher. Prop firms usually have strict risk management rules, and a single miscalculation can lead to big problems. The XABCD Position indicator ensures that every trade you make aligns with those rules by automatically updating your order sizes based on your risk settings. This not only protects your account but also gives your firm peace of mind that you’re managing risk like a pro.

Algo and High-Frequency Traders

Even if you’re deep into algorithmic or high-frequency trading, an extra layer of risk management is always welcome. The XABCD Position Tool works seamlessly with NinjaTrader’s advanced features, ensuring that even automated strategies stay within your defined risk parameters. This is particularly useful when the market is bouncing all over the place and you need your system to react quickly.

Putting it to "On" Mode

Indicator Properties Behind the XABCD Position Tool

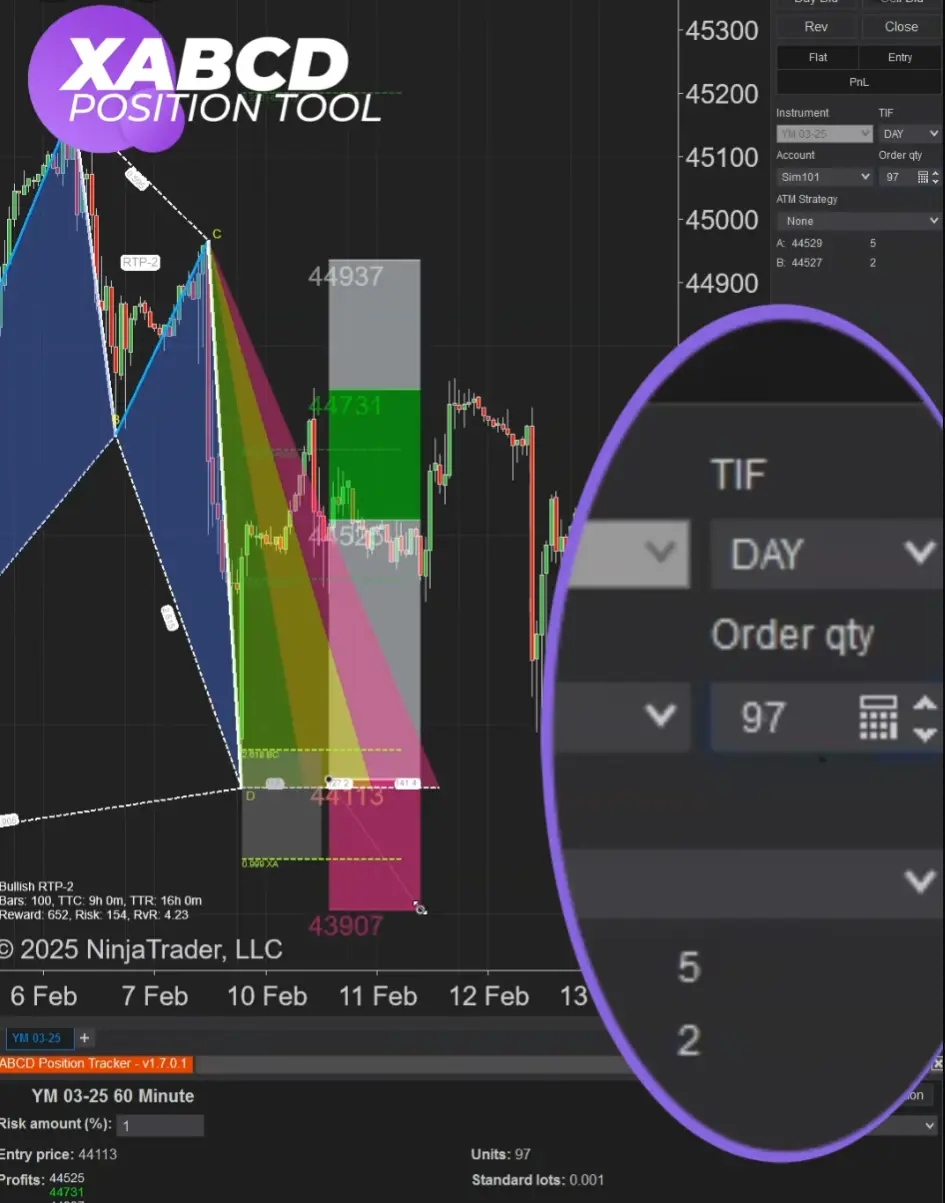

Inside the indicator properties you'll find the option to update the order qty box. Update ChartTrader Order Qty which you will want to have it checked on (if you want it to automatically update).

Draw Entry and Stop

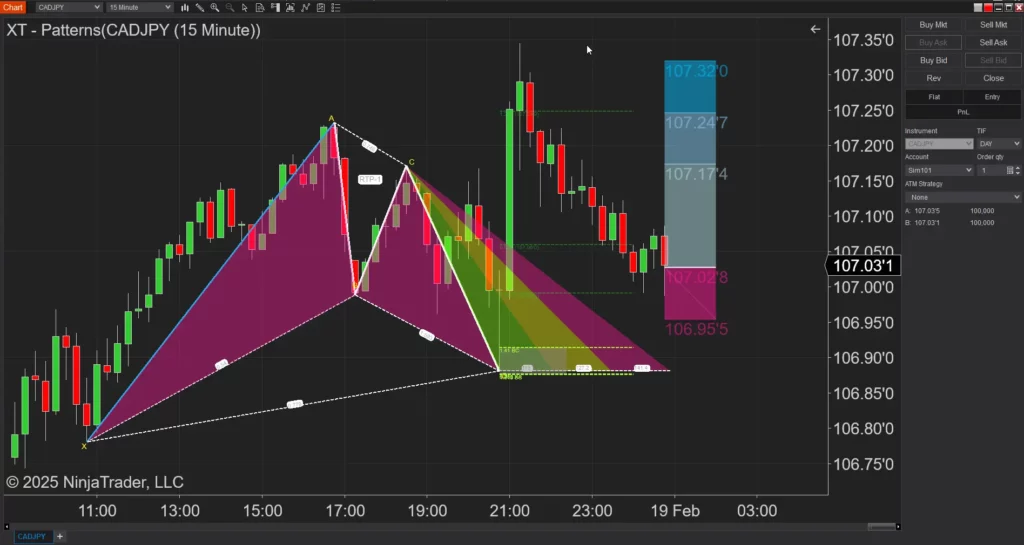

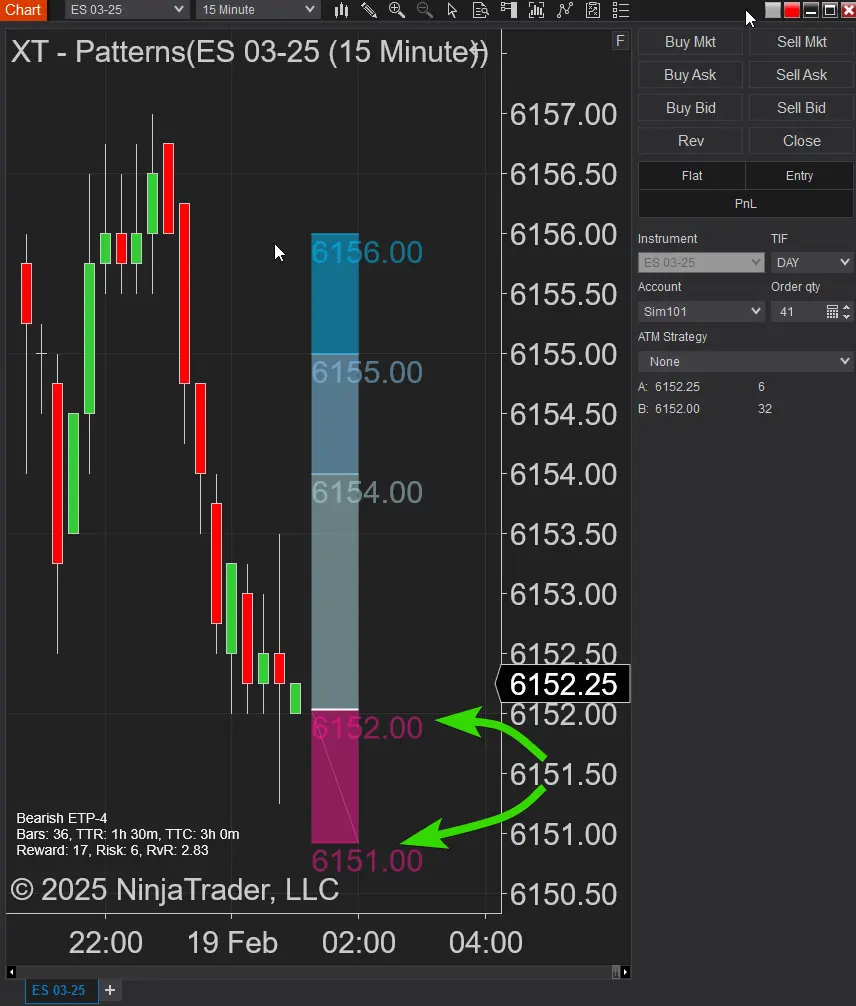

Next you will use the XABCD Position Drawing Tool to map in your entry and stops.

Watch It In Action

As you move around the stop and entry points, you will see the Order QTY box adjust like magic!

Breaking Down the Magic Behind the Tool

How It Works in a Nutshell

#1Risk Percentage: You decide how much of your account you’re willing to risk on a trade. This is your safety net, ensuring that no single trade can wipe out your capital.

#2 Entry and Stop Loss: Input your entry price and where you’d like to set your stop loss. The difference between these numbers tells you how much you’re risking per share or contract.

#3Automatic Calculation: The tool takes your risk percentage and the difference between your entry and stop loss to calculate exactly how many shares or contracts you should trade. No manual work, no room for error.

How It Works in a Nutshell

Let’s face it, trading is stressful enough without having to worry about the math behind your moves. By automating these calculations, the position tool lets you zero in on your strategy and the market. This means fewer mistakes, more consistent trading, and ultimately, a smoother trading experience overall.

Wrapping It All Up

The world of trading is demanding, and every edge counts. The XABCD Trading Position Tool for NinjaTrader isn’t just another fancy feature—it’s a real, practical solution that takes the guesswork out of order sizing. By automatically updating your order quantity based on your risk percentage, entry, and stop loss levels, it ensures that every trade is executed with precision and consistency.

Whether you’re a solo trader, a prop trader, or someone who relies on automated systems, this tool is designed to make your life easier and your trades safer. It’s all about reducing mistakes, saving time, and letting you focus on what really matters: making smart, calculated moves in the market.

So if you’re ready to take your trading to the next level, give the XABCD Trading Position Tool a try. Embrace the convenience of automated risk management and see how it can transform your trading experience. Here’s to smarter trading, better risk control, and ultimately, more success in the markets. Happy trading!

Apr. 06, 2025

From Lag to Lightning: The Critical Role of Read/Write Speeds in NinjaTrader 8

Mar. 08, 2025

NinjaTrader Margins Requirements for Futures Trading

Mar. 05, 2025

Order Rejected at RMS Meaning in NinjaTrader

Feb. 19, 2025

Boost Your Trading Efficiency: New Automated Order Quantity Feature for Seamless Position Management

Dec. 30, 2024

Are XABCD Patterns Still Useful in 2025?

Nov. 30, 2024

Aligning Time-Based Events with Non-Time-Based Charts for News Events in NinjaTrader 8

Nov. 11, 2024

Avoiding Costly Delays: How the XABCD Performance Indicator Identifies Lag Issues in Real-Time

Oct. 26, 2024

NinjaTrader 8 & One Drive Woes? Follow these steps.

Aug. 10, 2024

NinjaTrader and Evaluation Accounts: What You Need to Know

Jul. 25, 2024