Thinking of Trading at the C Point? Consider This First…

It Sounds Like A Great Idea.. Is It?

Let’s all get on the same page here before we discuss this in more detail. The concept that we’ve heard from traders is that they would like to know if they can be alerted to a pattern at the C point before it completes the D point.

An XABCD Pattern requires all 5 points to be completed X to A to B to C to D in order for the pattern to complete. Having 5 leg segments gives us an exact emotional movement in the market which we look to repeat.

However, some people wish to try and get an early jump on the pattern and ride the last wave of the pattern from the C point down to the D point. Then flip their trade and hope it rips back up playing both sides of the C to D leg.

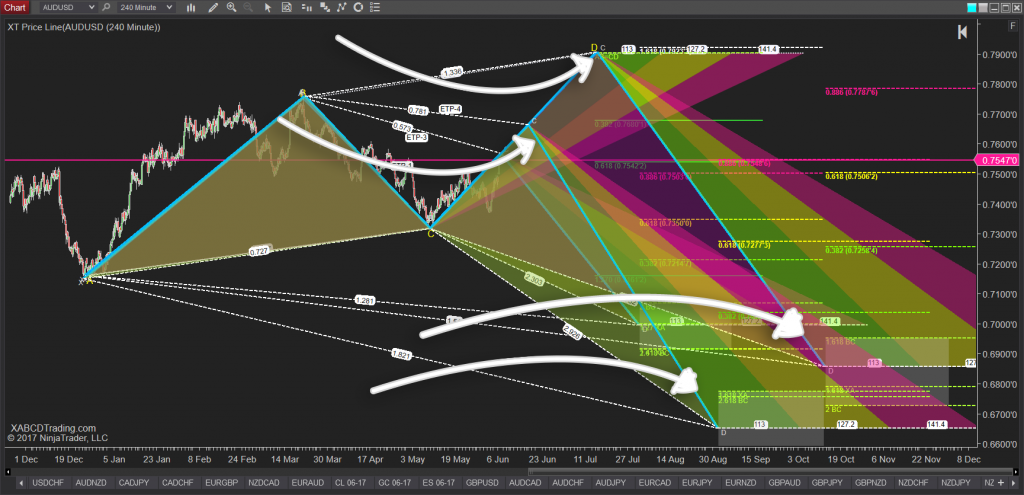

The image below has a circle over the C point of where some traders are trying to place a trade.

This Seems Fine Until We Dig Deeper

Does the pattern have to continue to the D point? Let’s look at a few examples:

Example 1: Below you will find a pattern where I’ve drawn in an XABCD pattern where both the price and time ratios align. The candlesticks have completed up to the C point of the pattern. This would be a potential pattern where the XABC points are formed and we are just waiting for the last point to happen.

We would expect now that price would keep going from the C Point to the D Point of the pattern. This could be a possibility but it is only one possibility.

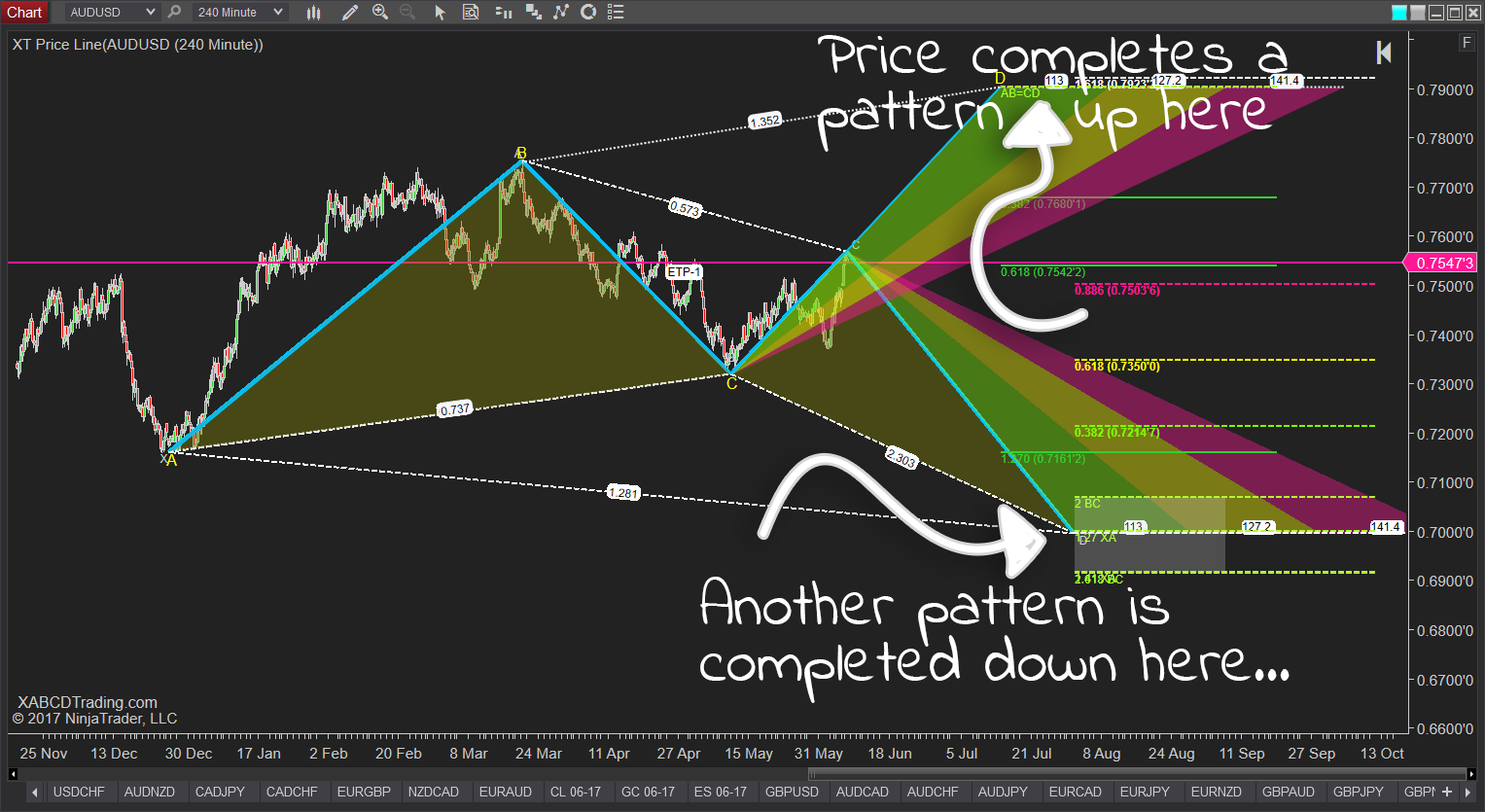

Here are more examples as you read lower… perhaps the pattern you thought was going to be completed by price going to the D point actually forms a pattern where it completes in the opposite direction? Now we have two possibilities at the C point of our original XABCD pattern. One result is that price could go to your original D point and you might end up being right. The second example shows that price could go in the opposite direction causing you to take a loss on the trade.

How will you know which way it will go?

Let’s overlay a 3rd possibility. Here is another XABCD Pattern, but in this case we’re looking for a move higher showing a 2nd possibility that the original D Point of the first projection wouldn’t come true.

Wait! It Get’s Worse! 50/50?

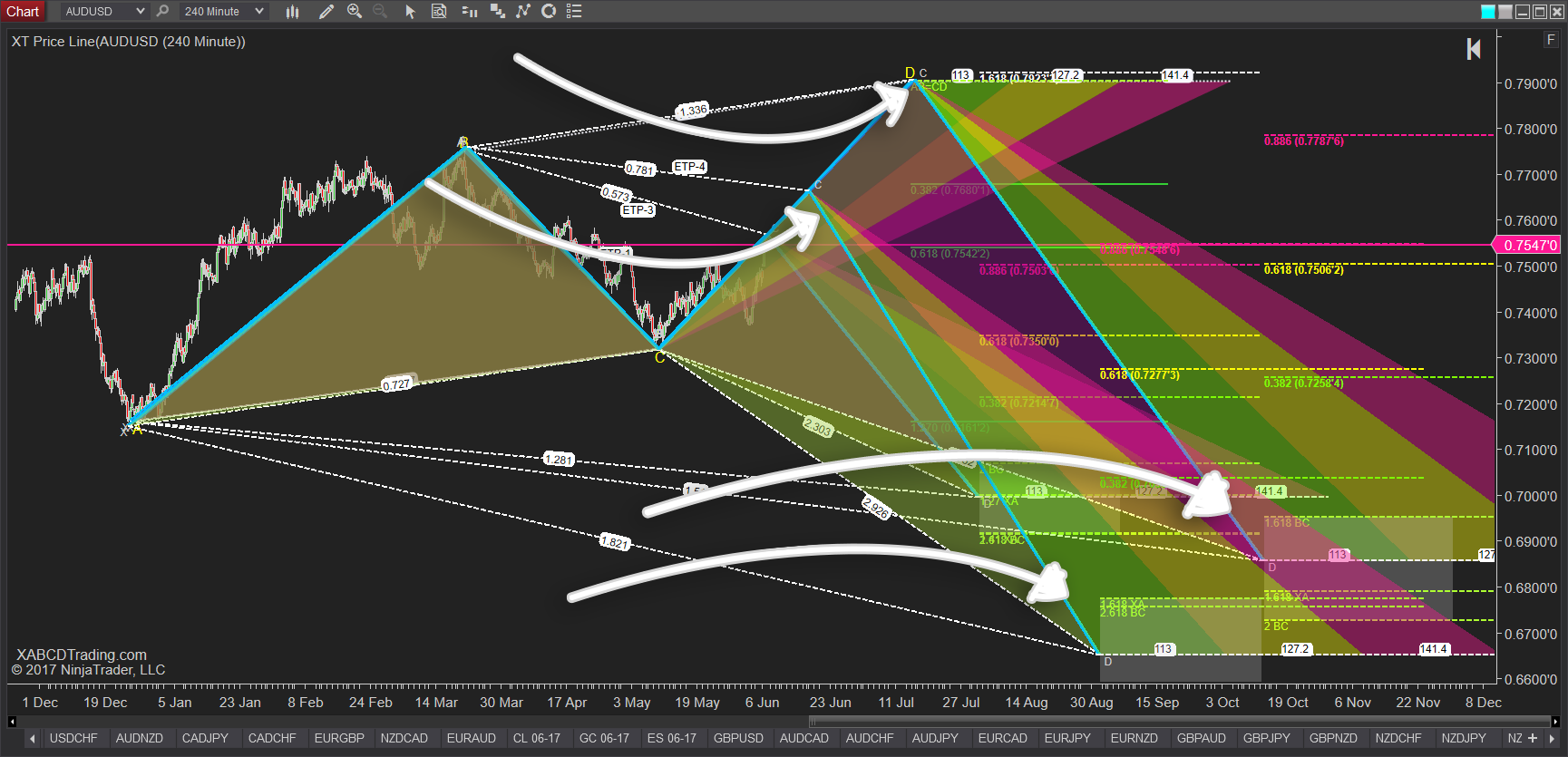

Here is another one, a reason to go short? Looks like we got 2 bullish patterns and 2 bearish – which way will it go? Better wait for the pattern to complete first.

Confused?

You have good right to be confused. When the XABC part of the pattern is formed, trying to forecast a D point isn’t where your odds lay as there are multiple directions of where price can go from the C point.

So Why Do People Do It?

If I was to guess where this started – it came from people getting tired of waiting for patterns to complete. It’s very possible that they didn’t have any way to have the patterns scanned and found.

We use the market analyzer within NinjaTrader 8 to look for patterns and it’s the work horse. All we have to do is wait for patterns to be announced and then decide if we wish to take them. There are more than enough patterns in a day to trade them once they all complete – more than anyone could probably need.

The Solution?

Wait until the pattern completes. Don’t try to force something that seems unclear. If you could scan for the patterns automatically and only be alerted to the ones that were completed – you wouldn’t feel forced to trade a pattern you didn’t like or try trading a pattern early by entering at the C point.

Have you done this in the past? Would you agree or disagree with these challenges? Feel free to post your comments below if you wish to share your own experiences.

Still Want Alerts at the C Point?

If you still want this, enable your alerts for your 4PP and then adjust your ratios so D doesn’t go above B. Instead of the labels being XABC you are just going to have them as ABCD which are 4 points. So have the market analyzer scan for 4 point patterns and you will pickup all the patterns that complete the “C Point”. You will however run into the same problem as above so I hope you have a solution ready to tackle the challenges listed above.

From Lag to Lightning: The Critical Role of Read/Write Speeds in NinjaTrader 8

NinjaTrader Margins Requirements for Futures Trading

Order Rejected at RMS Meaning in NinjaTrader

Boost Your Trading Efficiency: New Automated Order Quantity Feature for Seamless Position Management

Are XABCD Patterns Still Useful in 2025?

Aligning Time-Based Events with Non-Time-Based Charts for News Events in NinjaTrader 8

Avoiding Costly Delays: How the XABCD Performance Indicator Identifies Lag Issues in Real-Time

NinjaTrader 8 & One Drive Woes? Follow these steps.

NinjaTrader and Evaluation Accounts: What You Need to Know