XABCD Trading

Bloodhound Economic News Event Indicator

Why Does Every Bloodhound User Need News Events?

Shark Indicators' BloodHound is a trading software platform designed to assist traders in developing and implementing automated trading strategies. Integrating economic news events into BloodHound or any custom coding is crucial for several reasons, as it enhances the trader's ability to make informed decisions and adapt to market dynamics.

XABCD News Pro: This is a paid (one time) indicator that includes all your upgrades and is a lifetime license. Purchases it in our store.

Use Cases for News Events

Market Sentiment Analysis:

Economic news has a significant impact on market sentiment. By integrating economic news events into BloodHound, traders can gauge market sentiment shifts and make more informed decisions based on the prevailing mood of the market.

Volatility Prediction: Economic news often leads to increased volatility in financial markets. BloodHound, with integrated economic indicators, can help traders anticipate and prepare for potential volatility spikes. This allows for more effective risk management and strategic positioning.

Timing and Precision: Certain trading strategies are time-sensitive and require precise execution. Incorporating economic news events into BloodHound enables traders to time their entries and exits more accurately, aligning their strategies with key economic releases.

Volatility Prediction: Economic news often leads to increased volatility in financial markets. BloodHound, with integrated economic indicators, can help traders anticipate and prepare for potential volatility spikes. This allows for more effective risk management and strategic positioning.

Timing and Precision: Certain trading strategies are time-sensitive and require precise execution. Incorporating economic news events into BloodHound enables traders to time their entries and exits more accurately, aligning their strategies with key economic releases.

How To Get News Events Into Bloodhound?

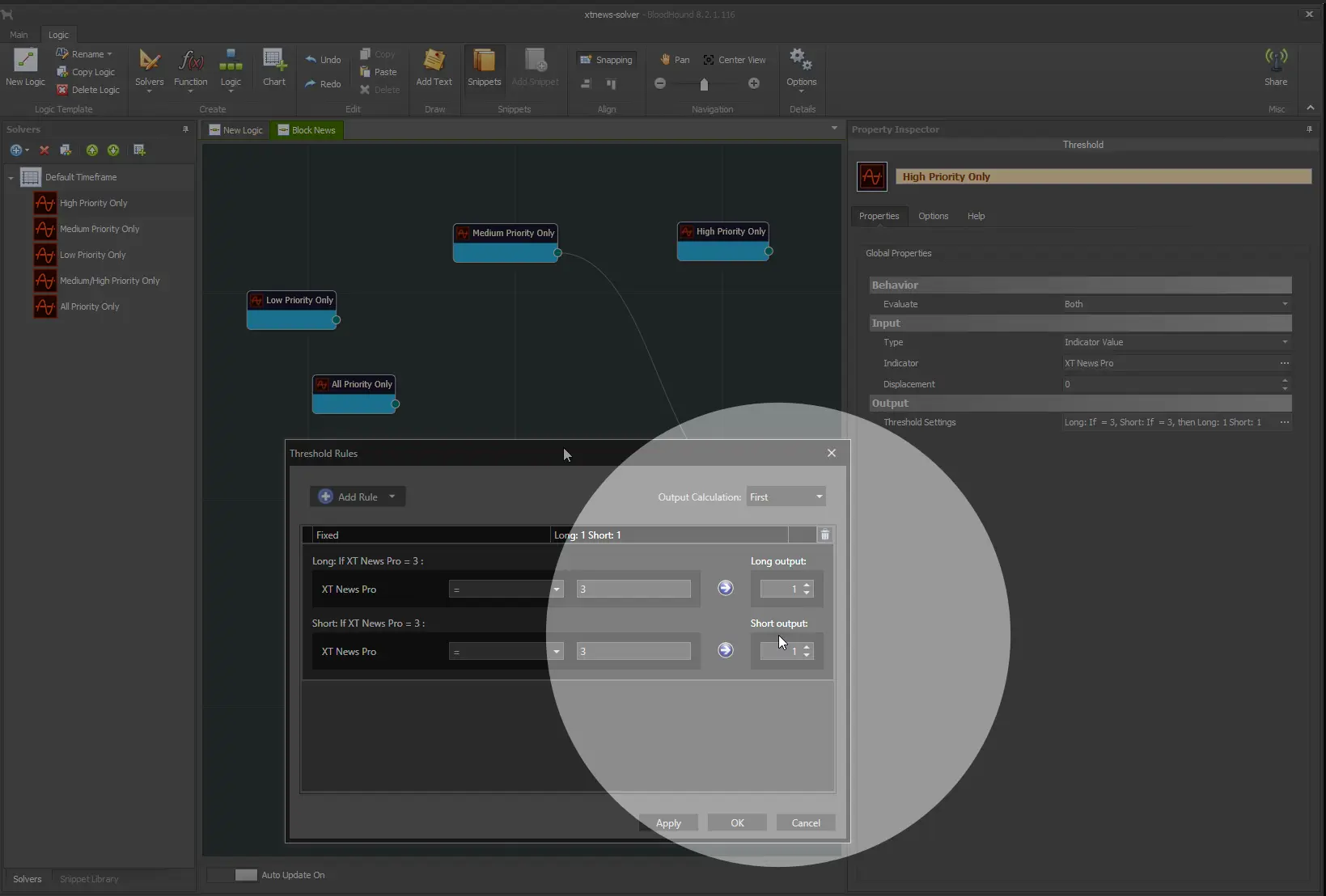

You will need to use the object called "Threshold Solvers" within the bloodhound software. These will allow you to specific if there is a news event and the value to look for to see.

Events

Returned Value

Holiday

4

High Priority

3

Medium Priority

2

Low Priority

1

Setting up Bloodhound with News

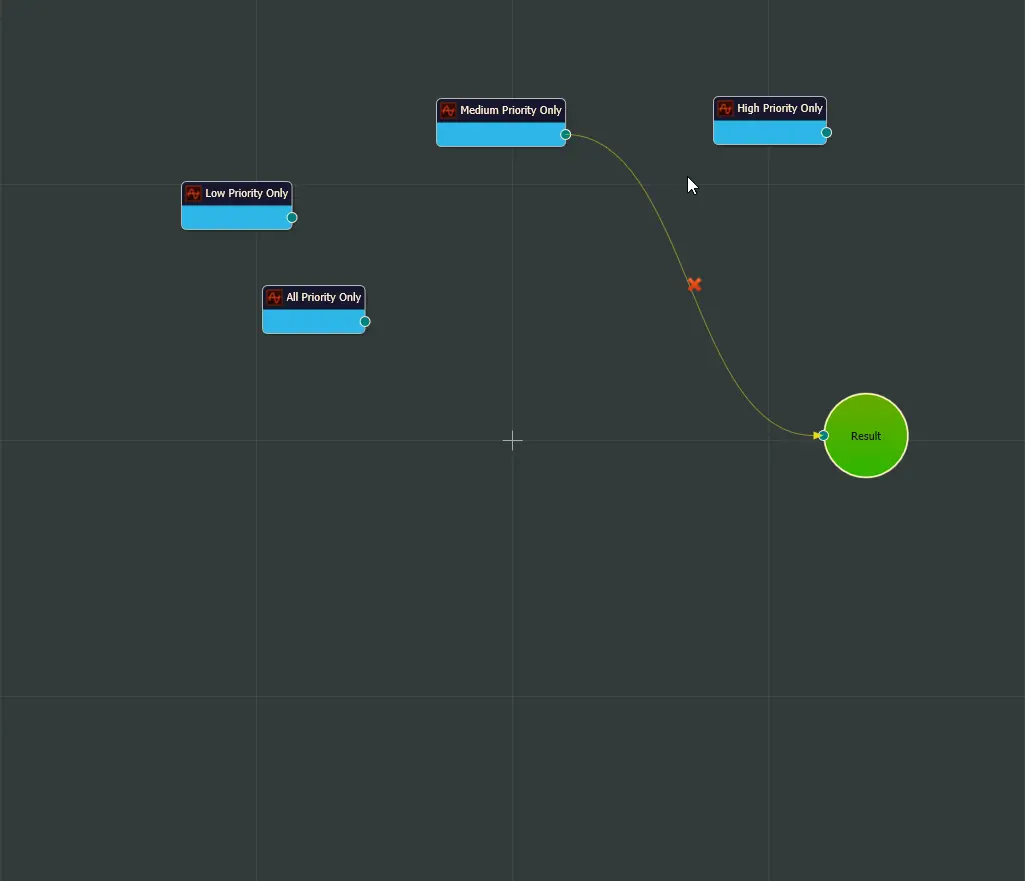

Your basic bloodhound template with the news solvers will look like this template. This template is available from support once you purchase the XABCD News Pro.

Your basic bloodhound template with the news solvers will look like this template. This template is available from support once you purchase the XABCD News Pro.

The configuration of each solver will be a value in the table above. For example, if you wanted bloodhound to detect a low priority news event you will create a threshold solver that has a value of 1. This value will be placed in both long and short configurations since it won't matter which direction you observe.

The image below will show you how this is all setup and configured.

Attaching Your News Template to Your Indicator Window

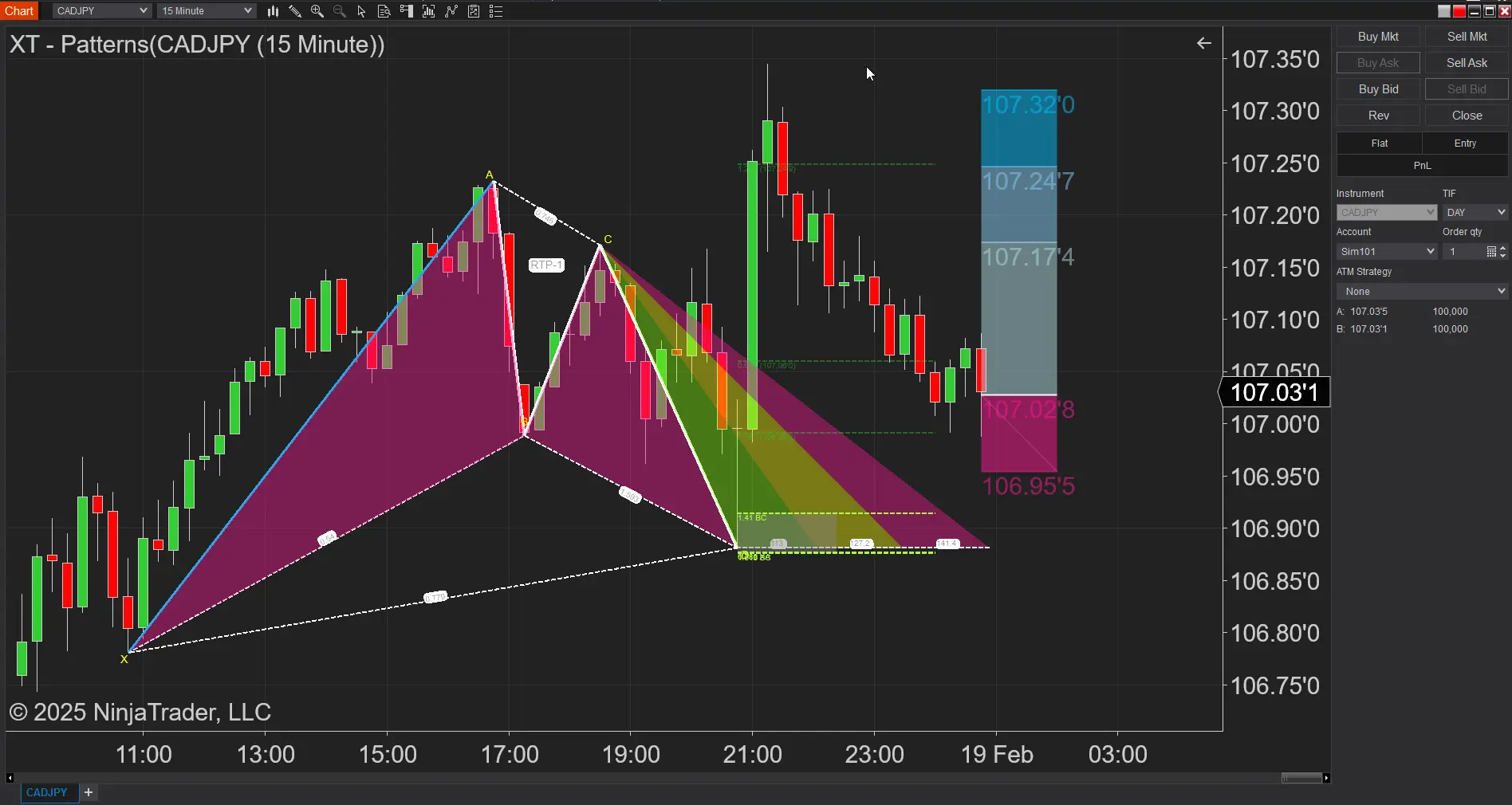

Now save that template and load up your bloodhound indicator into your chart window. Select the template from the dropdown that appeared on the chart menu bar. When you have a threshold solver attached to the results box, you should see your chart displayed like the one in the image below.

And that's it - you have setup your bloodhound to detect news events. Now you'll be able to work this into your existing bloodhound logic to pause trades around news events.

10 Ways Economic News Events Used With Automation Techniques?

Incorporating economic news events into an automated trading strategy can enhance the strategy's adaptability to changing market conditions and potentially improve overall performance. Here are some examples of how traders might use economic news events within an automated trading strategy:

#10Volatility-Based Triggers Automated strategies can be designed to respond to increased volatility triggered by significant economic news releases. For example, the strategy may adjust position sizes or temporarily suspend trading during high-impact news events to manage risk effectively. In the case of the XABCD News Pro, we use a buffer zone that we can halt news. The size of that buffer zone you can control in your indicator settings.

#9Event-Based Market Entries Certain automated strategies may be programmed to enter or exit positions based on specific economic indicators or news releases. For instance, a strategy might initiate trades when a particular economic indicator surpasses a predefined threshold, signaling a potential market movement. Using voltility to enter the market off a news event voltility was a method popular in the past but since, brokers have made modifications which can increase spreads or cause an entry to be a lot further way than you might expect. These days this is less of a strategy as its hard to get the execution you might be hoping to see and would be a lot more risky.

#8Trend Confirmation Economic news events can influence the overall market trend. Automated strategies can be designed to confirm or adjust their trading decisions based on whether economic data aligns with the prevailing trend. This helps avoid trading against strong fundamental shifts and certainly is one way to use the events we have in our XABCD News indicator.

#7News Sentiment Analysis Natural language processing algorithms can be integrated into automated systems to analyze news sentiment. This allows the strategy to gauge the overall sentiment around economic news events and make adjustments accordingly, such as tightening stop-loss levels in uncertain sentiment conditions.

#6Dynamic Stop-Loss and Take-Profit Adjustments Economic news events often lead to rapid price movements. Automated strategies can adjust stop-loss and take-profit levels dynamically based on the magnitude and direction of the price change triggered by the news event.

#5Risk Management Based on Economic Calendar Traders can use economic calendars to program automated strategies that temporarily reduce position sizes or avoid trading altogether during specific high-impact news releases. This helps minimize the potential impact of unexpected market movements.

#4Correlation Analysis Automated strategies can incorporate correlation analysis between currency pairs or assets and relevant economic indicators. This allows the strategy to adjust its exposure based on the interplay between different market factors.

#3Reaction Time Optimization Automation allows for swift execution of trades in response to economic news. Traders can program strategies to capitalize on immediate market reactions, exploiting short-lived price inefficiencies before the market fully adjusts.

#2Earnings Reports and Corporate Announcements Automated strategies designed for equity markets may consider incorporating corporate earnings reports and announcements into their decision-making process. Strategies could automatically adjust positions based on the outcomes of these events.

#1Statistical Arbitrage Opportunities Economic news events can create temporary pricing disparities between related assets. Automated strategies may identify and exploit these opportunities by executing trades that capitalize on the expected convergence of prices.

It's crucial for traders to thoroughly backtest and validate any automated strategy, especially those incorporating economic news events, to ensure robustness and adaptability under various market conditions. Additionally, risk management remains paramount to mitigate potential losses associated with unexpected market movements.

#10Volatility-Based Triggers Automated strategies can be designed to respond to increased volatility triggered by significant economic news releases. For example, the strategy may adjust position sizes or temporarily suspend trading during high-impact news events to manage risk effectively. In the case of the XABCD News Pro, we use a buffer zone that we can halt news. The size of that buffer zone you can control in your indicator settings.

#9Event-Based Market Entries Certain automated strategies may be programmed to enter or exit positions based on specific economic indicators or news releases. For instance, a strategy might initiate trades when a particular economic indicator surpasses a predefined threshold, signaling a potential market movement. Using voltility to enter the market off a news event voltility was a method popular in the past but since, brokers have made modifications which can increase spreads or cause an entry to be a lot further way than you might expect. These days this is less of a strategy as its hard to get the execution you might be hoping to see and would be a lot more risky.

#8Trend Confirmation Economic news events can influence the overall market trend. Automated strategies can be designed to confirm or adjust their trading decisions based on whether economic data aligns with the prevailing trend. This helps avoid trading against strong fundamental shifts and certainly is one way to use the events we have in our XABCD News indicator.

#7News Sentiment Analysis Natural language processing algorithms can be integrated into automated systems to analyze news sentiment. This allows the strategy to gauge the overall sentiment around economic news events and make adjustments accordingly, such as tightening stop-loss levels in uncertain sentiment conditions.

#6Dynamic Stop-Loss and Take-Profit Adjustments Economic news events often lead to rapid price movements. Automated strategies can adjust stop-loss and take-profit levels dynamically based on the magnitude and direction of the price change triggered by the news event.

#5Risk Management Based on Economic Calendar Traders can use economic calendars to program automated strategies that temporarily reduce position sizes or avoid trading altogether during specific high-impact news releases. This helps minimize the potential impact of unexpected market movements.

#4Correlation Analysis Automated strategies can incorporate correlation analysis between currency pairs or assets and relevant economic indicators. This allows the strategy to adjust its exposure based on the interplay between different market factors.

#3Reaction Time Optimization Automation allows for swift execution of trades in response to economic news. Traders can program strategies to capitalize on immediate market reactions, exploiting short-lived price inefficiencies before the market fully adjusts.

#2Earnings Reports and Corporate Announcements Automated strategies designed for equity markets may consider incorporating corporate earnings reports and announcements into their decision-making process. Strategies could automatically adjust positions based on the outcomes of these events.

#1Statistical Arbitrage Opportunities Economic news events can create temporary pricing disparities between related assets. Automated strategies may identify and exploit these opportunities by executing trades that capitalize on the expected convergence of prices.

It's crucial for traders to thoroughly backtest and validate any automated strategy, especially those incorporating economic news events, to ensure robustness and adaptability under various market conditions. Additionally, risk management remains paramount to mitigate potential losses associated with unexpected market movements.

Mar. 08, 2025

NinjaTrader Margins Requirements for Futures Trading

Mar. 05, 2025

Order Rejected at RMS Meaning in NinjaTrader

Feb. 19, 2025

Boost Your Trading Efficiency: New Automated Order Quantity Feature for Seamless Position Management

Dec. 30, 2024

Are XABCD Patterns Still Useful in 2025?

Nov. 30, 2024

Aligning Time-Based Events with Non-Time-Based Charts for News Events in NinjaTrader 8

Nov. 11, 2024

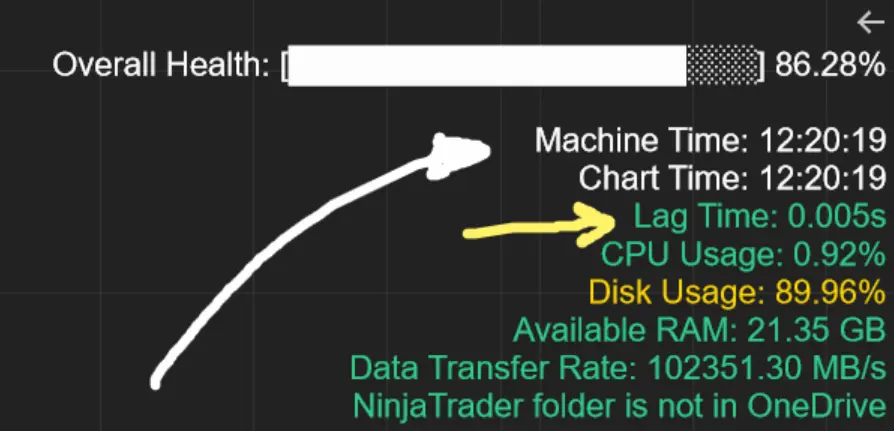

Avoiding Costly Delays: How the XABCD Performance Indicator Identifies Lag Issues in Real-Time

Oct. 26, 2024

NinjaTrader 8 & One Drive Woes? Follow these steps.

Aug. 10, 2024

NinjaTrader and Evaluation Accounts: What You Need to Know

Jul. 25, 2024

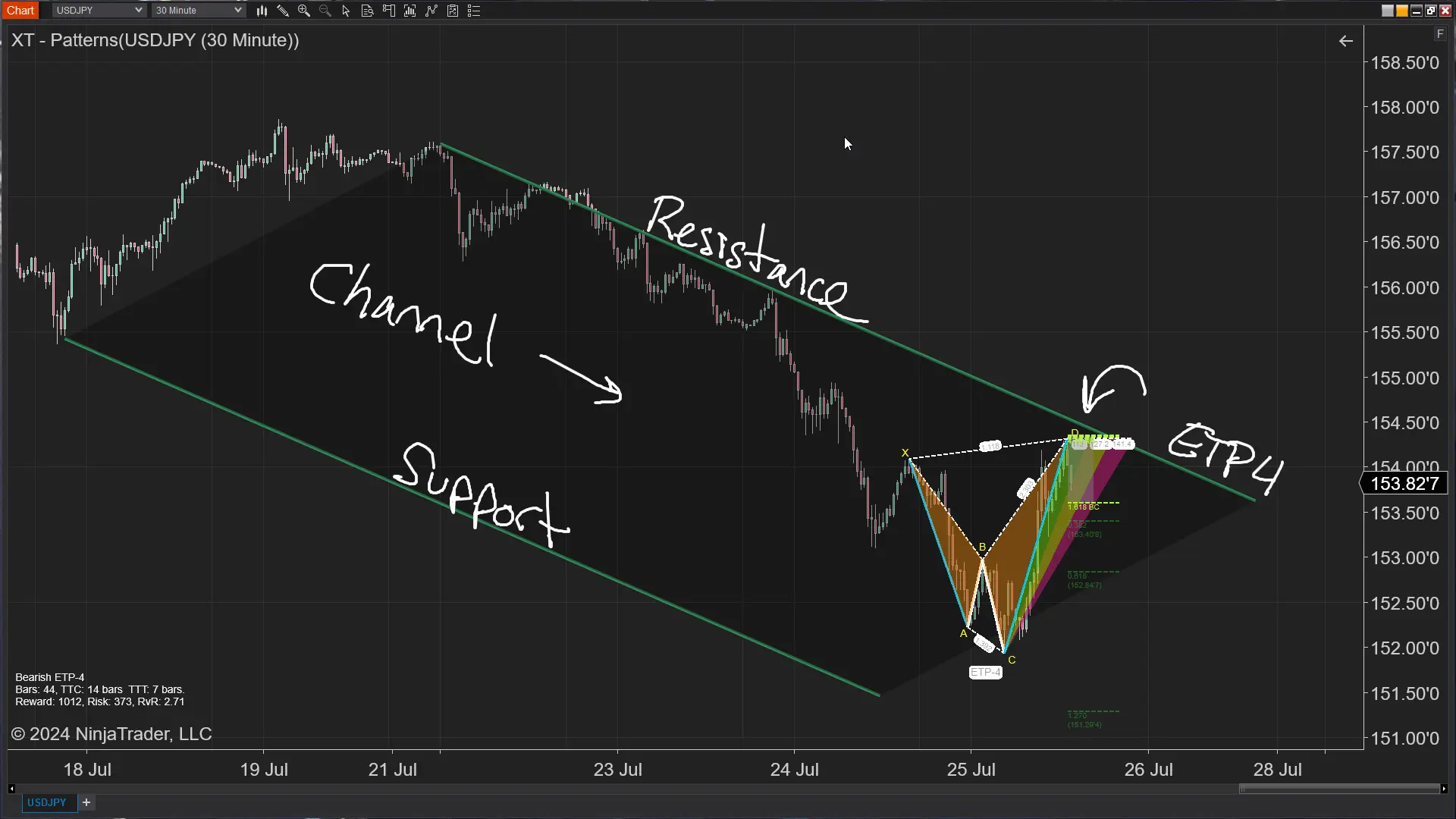

The ETP4 Pattern: Mastering Support and Resistance in Trading

Jul. 03, 2024