XABCD Trading

5 Steps to Improving Your Day Trading Risk Management

Day Trading Risk Management Tips

Trying to figure out your day trading risk management plan? Well you're in the right place. You might be new to trading, or been doing this for a while but the fact your even considering learning about risk puts you far beyond most traders. Yes, these risk management techniques we use with our xabcd patterns. However you can use them with any strategy. Let's dive right on on these tips you can start using with your trading.

Understand Your Monthly Maximum Drawdown

Tip 1 Understand your maximum monthly drawdown in a percentage. Probably one of the most over looked area's for many. They might understand what their maximum is per trade but if they think of it at a monthly level, they might rethink things. For example, you might be able to risk 5% per trade, but if you took 10 losing trades in a row, that's 50% of your account. Are you going to be able to stomach that much risk in a month? Is losing 50% of your account going to cause you to change your game plan? Trade long enough and losing 10 trades in a row is not uncommon, so for something pretty normal like this to happen (although hopefully more rare) its totally possible that by risking to much your taking actions you shouldn't be in other area's of your trading.

Never Move Your Stops Further Away

Tip 2 Get into a habit of placing your stops with your entry orders. Once they are placed, you should never move them further away. The only directions the stops should go is to reduce your risk. If you have found in the past you have moved your stops further away then its a sign your not placing your stops in the right place to begin with and you should reconsider your approach. A stop should always be in a place your comfortable getting out. For instance, we trade XABCD Patterns and if a pattern was to fail and perhaps a level of support/resistance than I'm quite comfortable in taking that trade as a loss.

Knowing Your Risk VS Reward and Why It's Critical

Tip 3 If you're not sure what your risk vs reward is, then think of it this way. What is your average profitable trade and avg losing trade? This will basically give you your risk vs reward number. Example, if you make on average $100 a trade and your avg loss is around $50, then your risk vs reward is a 2:1. Meaning you're making twice as much as your losing. Just like if you made $100 and risked $100 your risk vs reward is a 1:1. What you don't want for many is an inverted risk vs reward where your avg loss is greater than your avg gain.

Manage Your Risk in Percentages and Not Dollar Signs

Tip 4 Using percentages will let you scale your account a lot easier while maintaining the same risk equations. Risking 1% will always being the same, but risking a fix dollar value is going to have to change with every trade as your stop will be different and not fixed. This is another critical point, your stops should never always be a fixed dollar amount as you want your stops in a position that makes sense to get stopped out. If you're going to get stopped out, you better get stopped out and learn something from it. This is why its important to have your stop in a critical position if you're going to want to gain from a losing trade.

Sep. 28, 2025

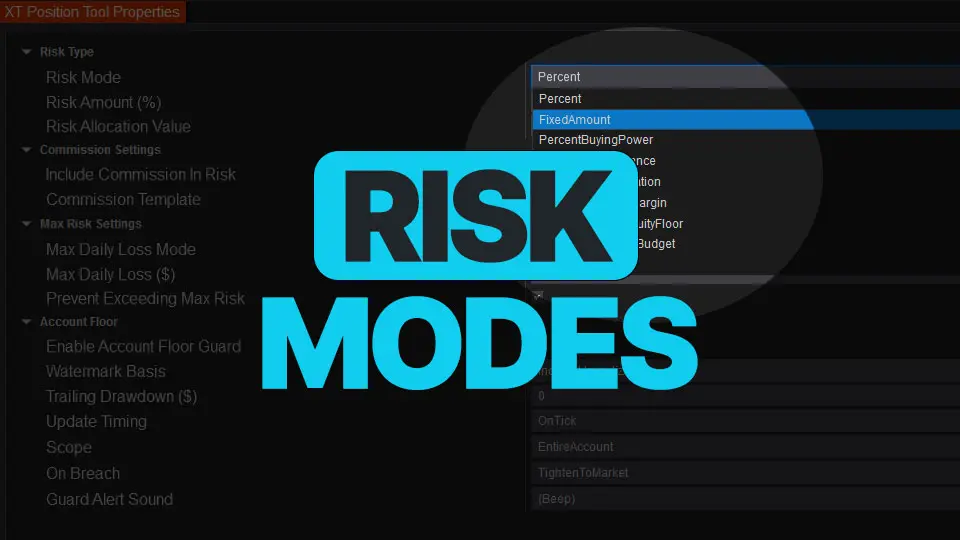

NinjaTrader Risk Management That Actually Moves the Needle

Sep. 25, 2025

NinjaTrader 8.1.6 — The “No Fluff” Tour (Speed, Clarity, Fewer Clicks)

Sep. 20, 2025

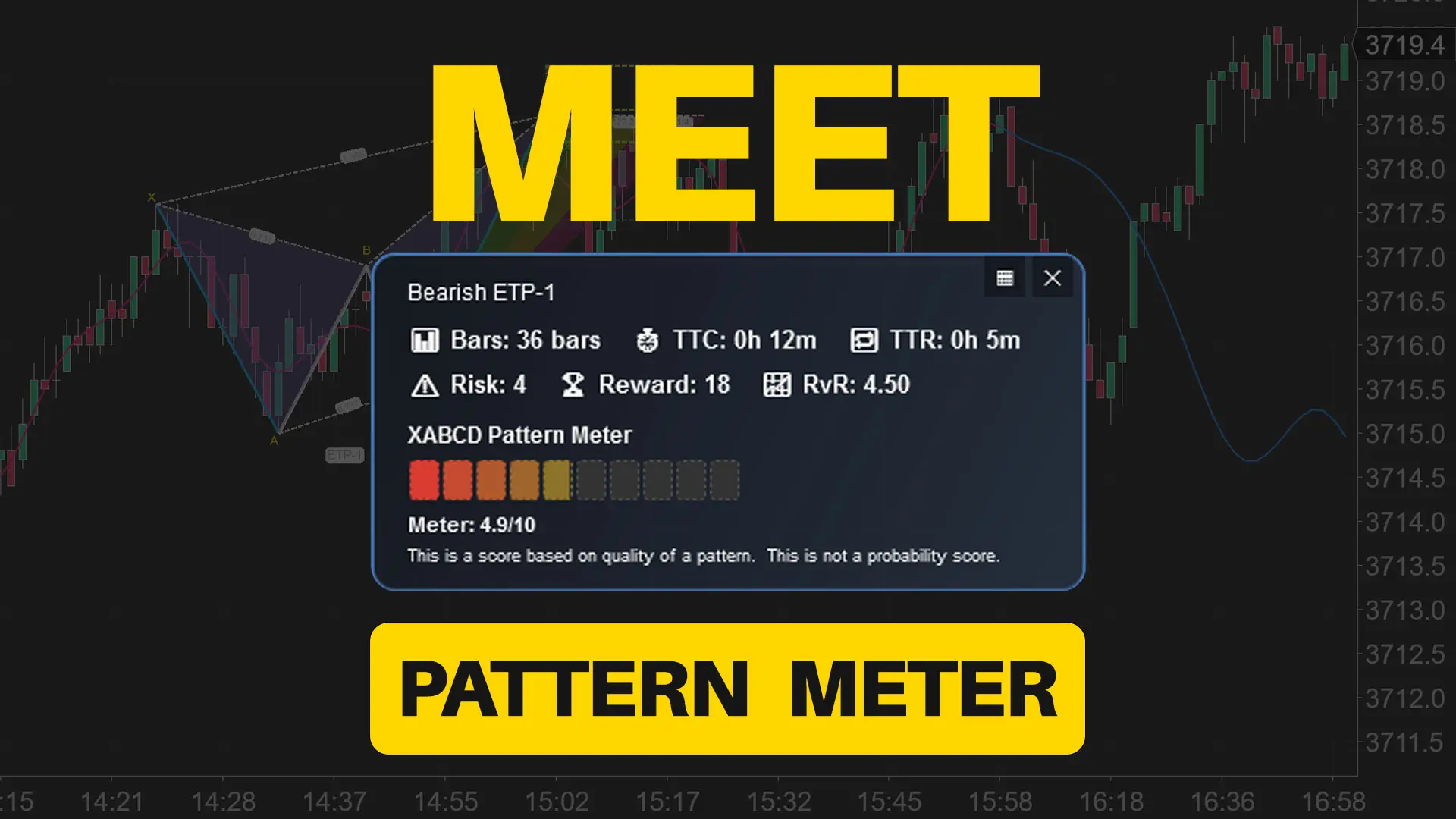

Meet the XABCD Pattern Meter (Real-Time Clarity)

Sep. 13, 2025

XT PriceLine: Dynamic Colors That Let You See Every Tick

Aug. 30, 2025

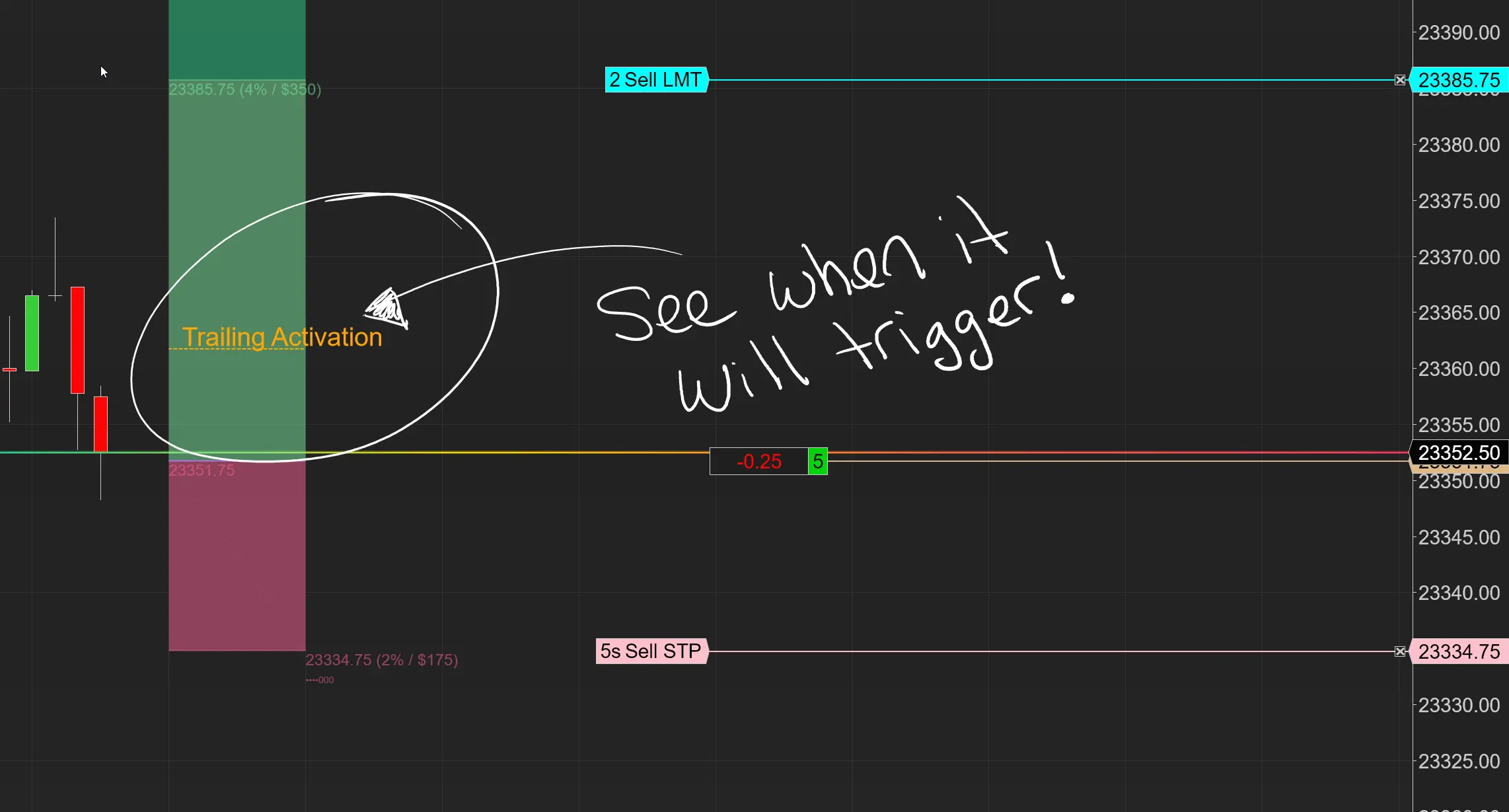

Dominate the Market with Smarter Trailing Stops in NinjaTrader

Jun. 17, 2025

Why Risking A Percentage of Your Account is Critical When Trading XABCD Patterns

May. 28, 2025

NinjaTrader 8.1.5 – They FINALLY Did It!

Apr. 30, 2025

Best ATM Strategy for NinjaTrader 8

Apr. 06, 2025

From Lag to Lightning: The Critical Role of Read/Write Speeds in NinjaTrader 8

Mar. 08, 2025