XABCD Trading

Mastering MIT Orders (Market If Touched) in NinjaTrader 8: A Simple Guide

Trading can be exciting. It can also be tricky. One tool that can help is the Market If Touched (MIT) order. In this guide, we will learn about MIT orders. We will also see how to use them in NinjaTrader 8. Whether you trade futures, forex, stocks, or crypto, this guide is for you.

What Is a Market If Touched (MIT) Order?

An MIT order is a special kind of order. It tells the system to buy or sell when the price reaches a certain point. When that price is touched, the MIT order becomes a market order. Then, it tries to get you the best price right away.

Why Use MIT Orders?

- Enter trades at the right time: You can set the price you want.

- Save time: The system watches the price for you.

- Control your trades: You decide when to buy or sell.

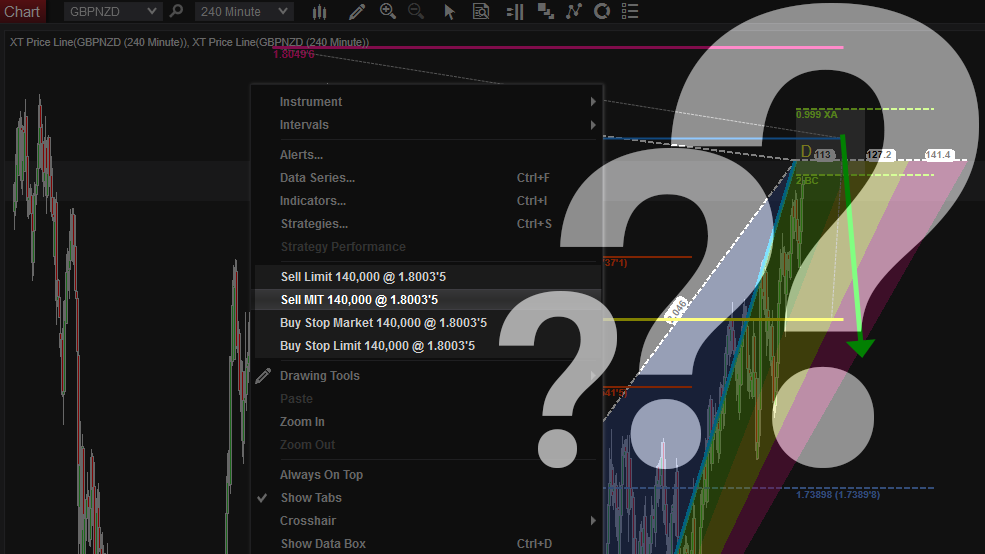

How to Place A MIT Order in NinjaTrader?

NinjaTrader 8 is a platform for trading. It lets you place MIT orders easily.

Steps to Place an MIT Order in NinjaTrader 8

- Open NinjaTrader 8: Make sure you are logged in.

- Go to the Order Entry Screen: This could be the Chart Trader or SuperDOM.

- Choose Your Instrument: Select the futures, forex, stock, or crypto you want to trade.

- Select MIT Order Type:

- In the order type menu, choose MIT.

- Set Your Price:

- Enter the price at which you want the MIT order to trigger.

- Place the Order:

- Click Buy MIT or Sell MIT.

- Confirm:

- Review your order and confirm it.

Where Are MIT Orders Held?

Base technology: MIT support

CQG: Simulated

FXCM: Simulated

Interactive Brokers: Native

MBT: Simulated

Rithmic: Native

TDA: Simulated

MIT support varies depending on the broker and technology used. The base technology includes MIT support. Brokers like CQG, FXCM, MBT, and TDA provide simulated support for MIT orders. On the other hand, Interactive Brokers and Rithmic offer native support for MIT orders.

CQG: Simulated

FXCM: Simulated

Interactive Brokers: Native

MBT: Simulated

Rithmic: Native

TDA: Simulated

MIT support varies depending on the broker and technology used. The base technology includes MIT support. Brokers like CQG, FXCM, MBT, and TDA provide simulated support for MIT orders. On the other hand, Interactive Brokers and Rithmic offer native support for MIT orders.

Does It Work Differently for Futures, Forex, Stocks, or Crypto?

MIT orders work mostly the same across different markets. But there are some small differences.

Futures

Common Use: MIT orders are often used in futures trading. Order Handling: The exchange usually holds the MIT order.

Forex

Availability: Some brokers may not support MIT orders in forex. Check with Broker: Always check if MIT orders are allowed for forex trades.

Stocks

Order Routing: Stock exchanges handle MIT orders. Time in Force: You can set how long the order stays active.

Crypto

Varies by Platform: Not all crypto exchanges support MIT orders. NinjaTrader Support: If trading crypto through NinjaTrader, check if MIT orders are available.

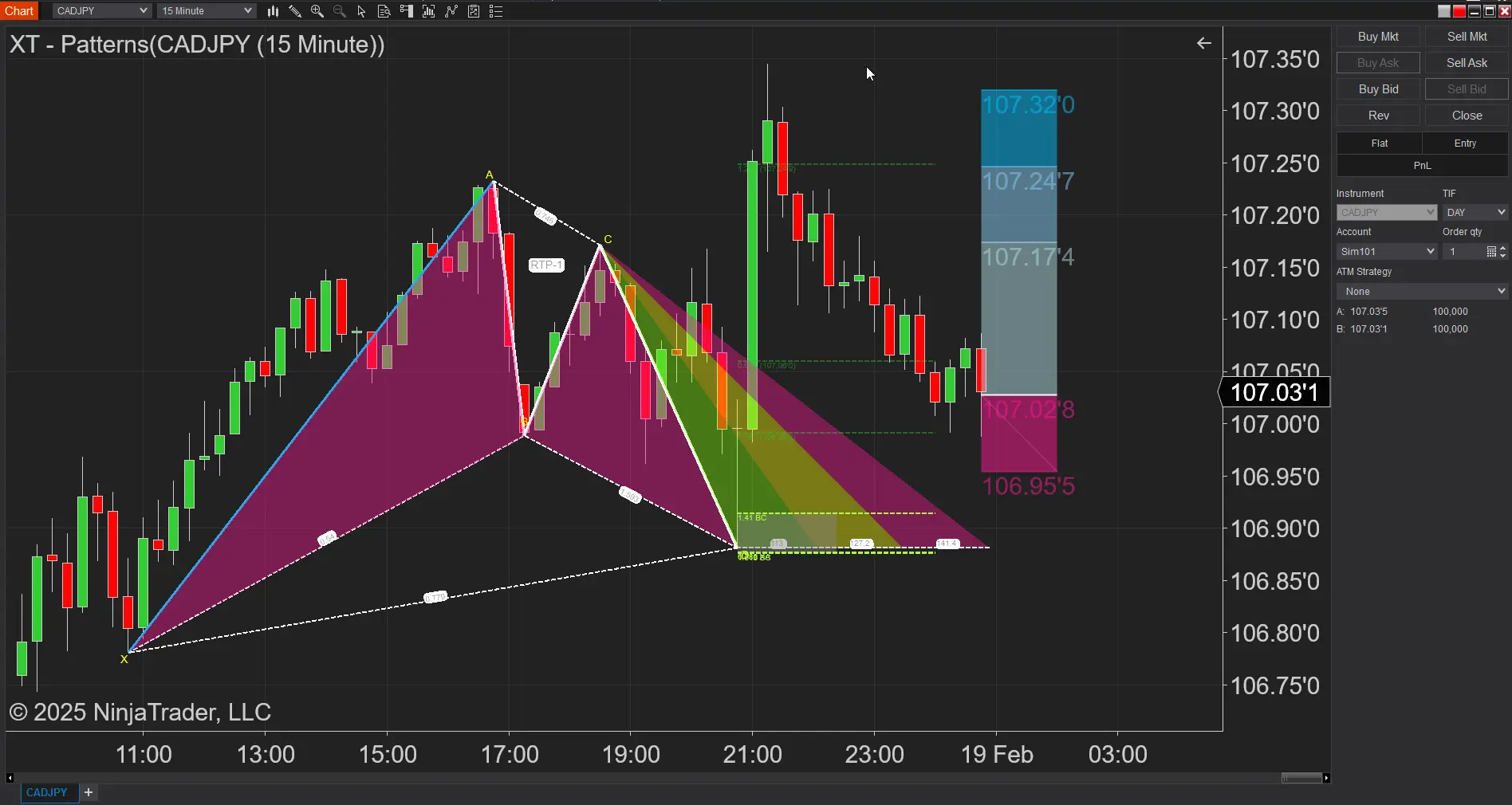

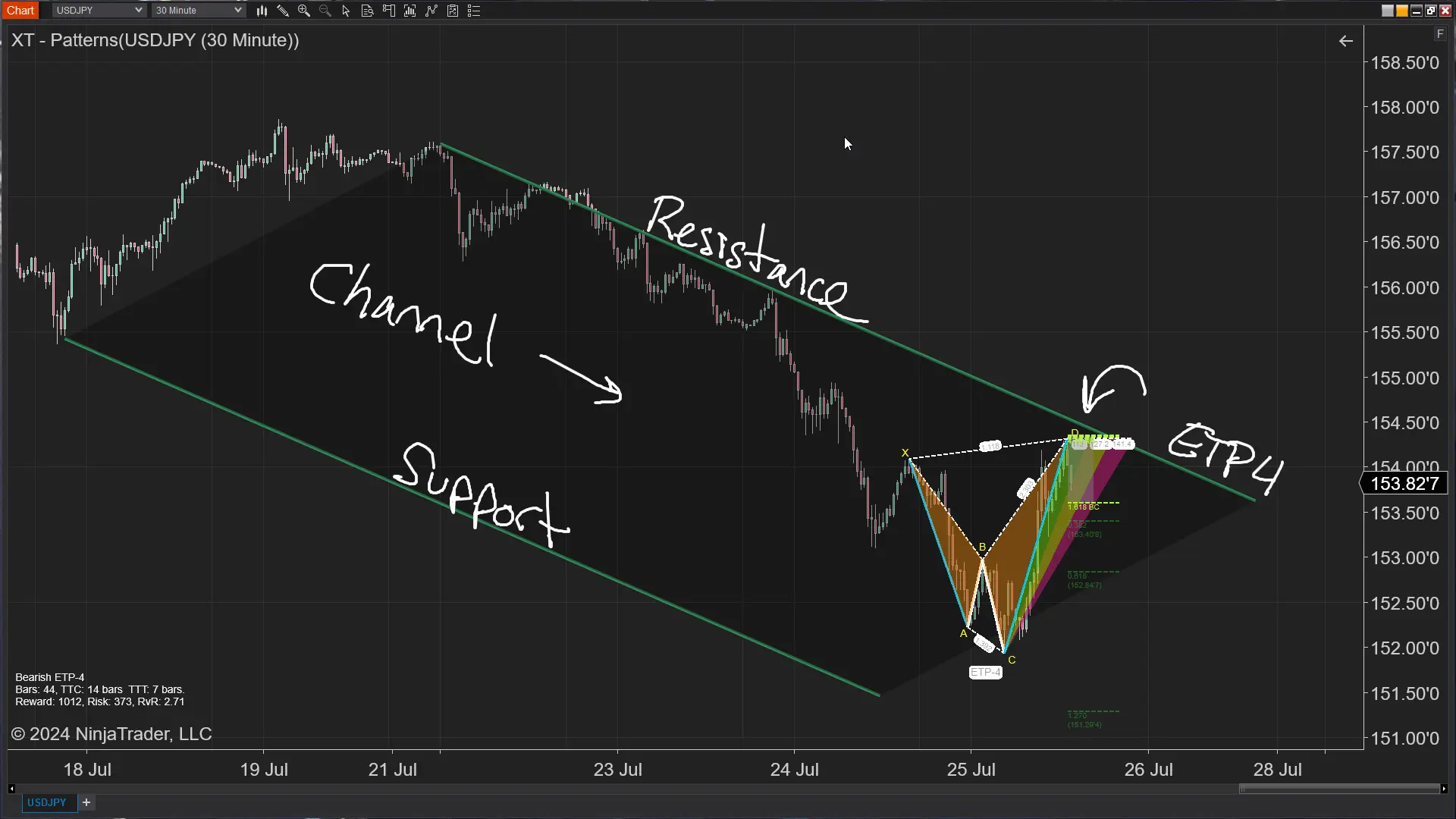

Using MIT Orders with XABCD Patterns

XABCD patterns are shapes on a chart. They help traders find good times to buy or sell. There are four patterns we will talk about: ETP1, ETP2, ETP3, and ETP4.

How Can MIT Orders Help XABCD Pattern Traders?

When trading these patterns, you may want to enter a trade when the price reaches a certain level. An MIT order can do this for you.

How Can MIT Orders Help XABCD Pattern Traders?

- Identify the Pattern: You see an ETP1 pattern forming.

- Determine Entry Point: You decide the best price to enter.

- Place MIT Order: Set an MIT order at that price.

- Automatic Entry: When the price touches your point, the MIT order becomes a market order.

Note: If using MIT orders directly on the chart, your chart trader needs to be open so your orders are within the menu when you right click on the chart.

How Can MIT Orders Help XABCD Pattern Traders?

- Precision: Enter trades at the exact point of the pattern.

- Time-Saving: No need to watch the chart all day.

- Reduce Emotion: Stick to your plan without second-guessing.

Tips for NinjaTrader Users

Always Check Order Status

- Order Tab: Use the Orders tab to see your MIT orders.

- Working Orders: Usually shown in yellow.

- Filled Orders: Shown in green.

- Color Codes:

Know Your Broker's Policies

It's important to understand that some brokers may handle MIT orders differently, so always check their order handling procedures. Additionally, be aware of any fees associated with different order types.

Practice in Simulation Mode

Using NinjaTrader's simulation mode provides a safe environment to practice placing MIT orders. This allows you to learn the platform and become comfortable with its features before trading with real money.

Tips for NinjaTrader Users

MIT orders are a helpful tool in trading. They let you enter or exit trades when the price reaches a certain point. In NinjaTrader 8, placing an MIT order is simple. Whether you trade futures, forex, stocks, or crypto, MIT orders can enhance your trading.

For XABCD pattern traders, especially those using ETP1 to ETP4 patterns, MIT orders can make trading easier and more precise.

Remember to always check with your broker about how MIT orders are handled. Practice using them in NinjaTrader 8 to get the most out of your trading strategy.

Happy trading!

Apr. 06, 2025

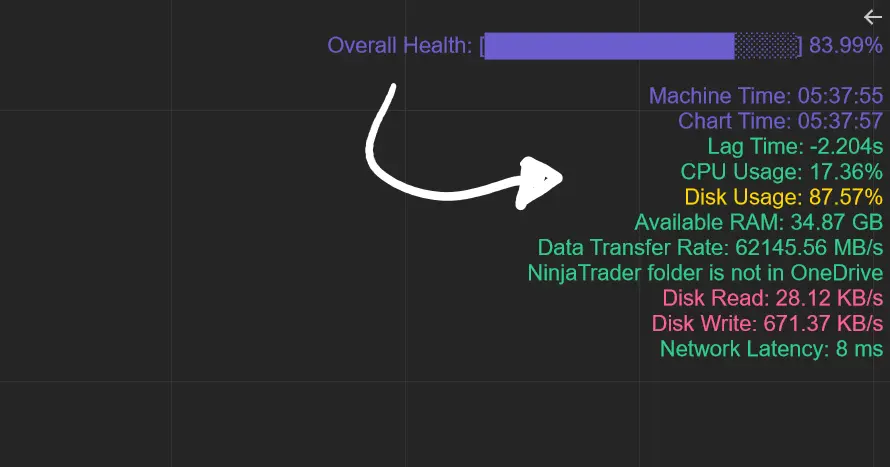

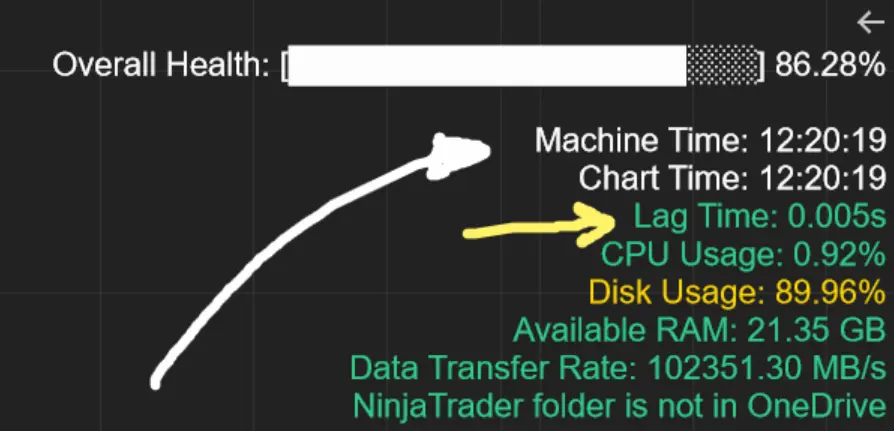

From Lag to Lightning: The Critical Role of Read/Write Speeds in NinjaTrader 8

Mar. 08, 2025

NinjaTrader Margins Requirements for Futures Trading

Mar. 05, 2025

Order Rejected at RMS Meaning in NinjaTrader

Feb. 19, 2025

Boost Your Trading Efficiency: New Automated Order Quantity Feature for Seamless Position Management

Dec. 30, 2024

Are XABCD Patterns Still Useful in 2025?

Nov. 30, 2024

Aligning Time-Based Events with Non-Time-Based Charts for News Events in NinjaTrader 8

Nov. 11, 2024

Avoiding Costly Delays: How the XABCD Performance Indicator Identifies Lag Issues in Real-Time

Oct. 26, 2024

NinjaTrader 8 & One Drive Woes? Follow these steps.

Aug. 10, 2024

NinjaTrader and Evaluation Accounts: What You Need to Know

Jul. 25, 2024