XABCD Trading

Most Reliable Candlestick Patterns for Increasing Your Consistency

Most Reliable Classifications of Patterns

Knowing which candlestick patterns to use is an important step. There are three classification of patterns.

- 1, 2 or 3 bar reversal patterns

- Price patterns such as the head and shoulders or flag pattterns

- XABCD Patterns - Which are the only ones to use price and time ratios for increased consistency

They all can have a place in your trading strategy. However, they will need to be used in the right situation. Knowing when and where to use them will be critical. They also work extremely well when used in conjunction with our ATM Pack of tools for the NinjaTrader 8 platform. This will let you auto move stops to breakeven and automate little tasks. Currently has been used by over 4000 NinjaTrader users.

The Most Reliable Chart Patterns

What Is the Most Reliable Candlestick Pattern?

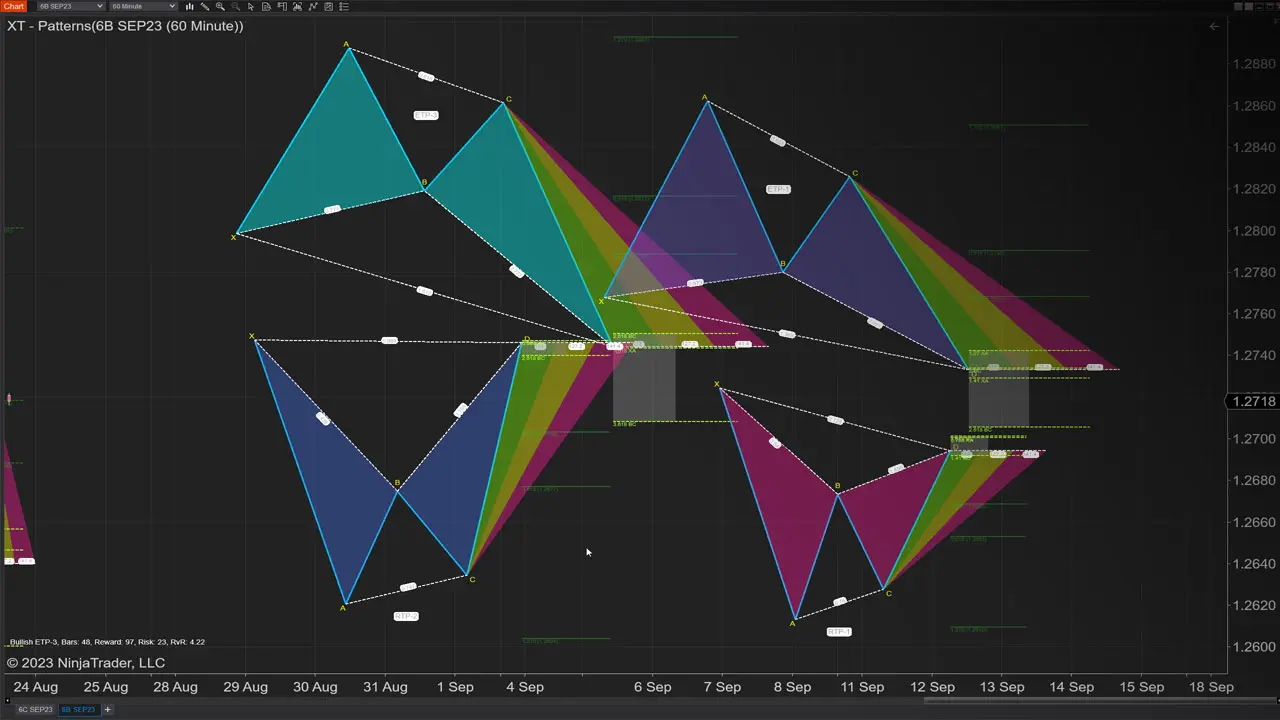

The most reliable classification of patterns are known as the XABCD Patterns. These go beyond your classical chart patterns by including both price and time fibonacci measurements.

The most reliable of the XABCD Patterns are going to be your ETP-3 (Extension Time Pattern #3) and your ETP-4 (Extension Time Pattern #4).

Why Is This Pattern Commonly Used?

When the ETP-3 or ETP-4 patterns form, they usually have a decently sized entry point. This gives you some flexibility for the XABCD Scanner to look for nested patterns. These patterns also give you a bit more wiggle room to get a good risk vs reward which can be the cornerstone of anyone's trading method.

XABCD Pattern Strategy Overview

How To Trade The XABCD Chart Pattern?

If you're new to using time and price fibonacci ratios with patterns, I would highly encourage you to watch this video that does a complete overview of the strategy in under 2 minutes. If you think that might be something to explore, feel free to grab us on the live chat and we'll get you a bunch of resources to get started. I would also recommend our xabcd pattern page to learn more.

The Least Reliable Chart Pattern

The most common type of pattern is our RTP-1 (Retracement Time Pattern #1). This is also the less frequently traded pattern because it's less reliable when trying to find a good Risk vs Reward. It's not an issue with success rate or anything like that, but instead it's not common to hit all the criteria we would need in a tradable pattern. This is why with all our youtube videos the RTP-1 is hardly shown. It's just really hard to get a good risk vs reward on this one as well as finding it in the right situation.

Apr. 06, 2025

From Lag to Lightning: The Critical Role of Read/Write Speeds in NinjaTrader 8

Mar. 08, 2025

NinjaTrader Margins Requirements for Futures Trading

Mar. 05, 2025

Order Rejected at RMS Meaning in NinjaTrader

Feb. 19, 2025

Boost Your Trading Efficiency: New Automated Order Quantity Feature for Seamless Position Management

Dec. 30, 2024

Are XABCD Patterns Still Useful in 2025?

Nov. 30, 2024

Aligning Time-Based Events with Non-Time-Based Charts for News Events in NinjaTrader 8

Nov. 11, 2024

Avoiding Costly Delays: How the XABCD Performance Indicator Identifies Lag Issues in Real-Time

Oct. 26, 2024

NinjaTrader 8 & One Drive Woes? Follow these steps.

Aug. 10, 2024

NinjaTrader and Evaluation Accounts: What You Need to Know

Jul. 25, 2024