Head-to-Head Comparison Between Tradingview and NinjaTrader in 2025

Pro's and Con's of TradingView Vs NinjaTrader

TradingView and NinjaTrader are two different platforms - each with their own pro's and con's. So let's discuss their strengths and weaknesses. We're going to be comparing Tradingview Premium with NinjaTrader 8.

We have broke these down into a few different categories:

Who Uses TradingView vs NinjaTrader?

TradingView

NinjaTrader

Key Takeaways on Who Uses Which Trading Platform

TL;DR: TradingView is easier to get started because there is nothing to install or setup, NinjaTrader will have an all-in-one solution to all of your futures trading and is so much more configurable and with really nice advanced features.

Cost Showdown: TradingView vs NinjaTrader

TradingView

NinjaTrader

NinjaTrader Pricing is Easy To Understand

Option 2: $99/month + 0.25 micro, or $0.99 / Standard

Option 3: $1499 + 0.09 micro, or $0.59 / Standard

TradingView Brokers

TradingView Brokers

- WH-Selfinvest (only Futures/Options Account)

- AMP Global Clearing

- Advantage Futures

- Dorman Trading

- Global

- Mirus

- Phillip Capital

- RJO'Brien

- Rosenthal Collins Group LLC

- Robbins Trading

- Straits Financial

- Tradovate

- Wedbush

- Modalmais

- Modalmais

- Alor

- OANDA

- FOREX.com

- DirectFX

- Poloniex

NinjaTrader Brokers

- NinjaTrader Brokerage

- Interactive Brokers

- Interactive Brokers

- TD Ameritrade

- WH Selfinvest

- Oanda

- FOREX.com

- Cityindex CFD

- Coinbase (Data Only)

Order Types Supported By Platform

Conclusion: NinjaTrader will support more order types and advanced ways of placing orders.

Order types are limited in TradingView. For example, it was only on Apr 19, 2019 that TradingView started supporting trailing stop losses in Oanda. You would then need to find out from TradingView what order types are supported and what ones are not?

NinjaTrader on the other hand has many order types that are supported and the ones that are not supported on the broker themselves (like MIT orders) can be simulated on the client side for some brokers too. Therefore NinjaTrader will easily win on order types.

Using TradingView vs NinjaTrader

Conclusion: NinjaTrader supports a full programming language - Win for NinjaTrader in this category

Custom Indicators

TradingView uses their own "pine" programming language which is cloud based and your limited on how many resources you can use. Thus your indicators and what you can do are also very limited.

NinjaTrader on the other hand is using local resources and thus you can create whatever you need. TradingView is putting limits on your trading and what you require and forcing you to trade inside a box isn't good and they do it because they are cloud based.

Take something as simple as our free news indicator for ninjatrader. Something like this would be impossible to do in TradingView's pine language. However having news events to warn you about upcoming news can be extremely useful. You might move stops up sooner, or hold off entering a position. A simple tool like this can potentially reduce risk by keeping you informed. It's something you can do with NinjaTrader.

Your Trading Workspace

Conclusion: NinjaTrader will let you use endless amounts of chart windows, tabs and workspaces.

TradingView will really fall apart in this category because they let you see a limited number of charts all at once. At the time of writing this article the max you can see is 8. That's if you're paying top dollar. If you have one of their more basic packages you'll probably only be able to see 1 or 2 of the charts at once.

NinjaTrader on the other hand will let you open as many windows as you want and as many tabs as you want. If you trade multiple markets this will become even more important.

Mobile Platform

Conclusion: Mix bag - No Clear Winner

TradingView has an app but the performance of this app seems to have tanked after reading recent reviews. People are complaining about a sluggish chart and even questioning what they are paying for in their subscription if the app can't be used.

On the other hand NinjaTrader doesn't even support and app and focus their dev cycles on their desktop product. I would actually agree with NinjaTrader on this because they will connect to other brokers. Eg. NinjaTrader doesn't have an app but Interactive Brokers (who NinjaTrader supports) does have an app. NinjaTrader doesn't need create the wheel again by creating an app as that would also take time away from their product development. Let the brokers create apps and do what they do best.

An app for NinjaTrader would probably be a disaster cause it could never be as feature rich as as their main platform so I hope they never try to attempt this path.

Alerts Within The Platform

Conclusion: NinjaTrader wins as they allow for unlimited alerts.

You would think any trading platform would have alerts - and both of these do. However TradingView sets limits on how many you can have. There is really no other reason for them to do this except to get users of theirs to spend more money. Can you imagine if you were only limited to 8 alerts?

Because TradingView is stopping alerts from being used, then you can only image all their other limits to which there are many. Eg, if you want to use range bars, your going to get bumped up a package. If you want to export your chart data, you will get bumped up to another package. This is why in our cost analysis we had to review the 59.95 package as that would give you most of the features.

Learning Curve

There is no real learning curve for TradingView which is why its a widely popular platform. Users head to a website and bamm, everything is there - just very limited.

NinjaTrader on the other hand will have a much bigger learning curve but not to worry, we have a bunch of tutorials to help you out, just keep watching the ones in blue.

Final TradingView vs NinjaTrader Comments

If you're out and about and just need a quick check on quotes, TradingView can be a useful webpage. They have a large social room (which i'm still pretty sure is just a distraction as the conversations are not very insightful) but its a great place to see a chart and check a quote.

NinjaTrader however is more useful as a trading platform and doing what they do best. It will be what you will use 80% of the time and only when you need quick access to a chart will you load up the TradingView website.

NinjaTrader Risk Management That Actually Moves the Needle

NinjaTrader 8.1.6 — The “No Fluff” Tour (Speed, Clarity, Fewer Clicks)

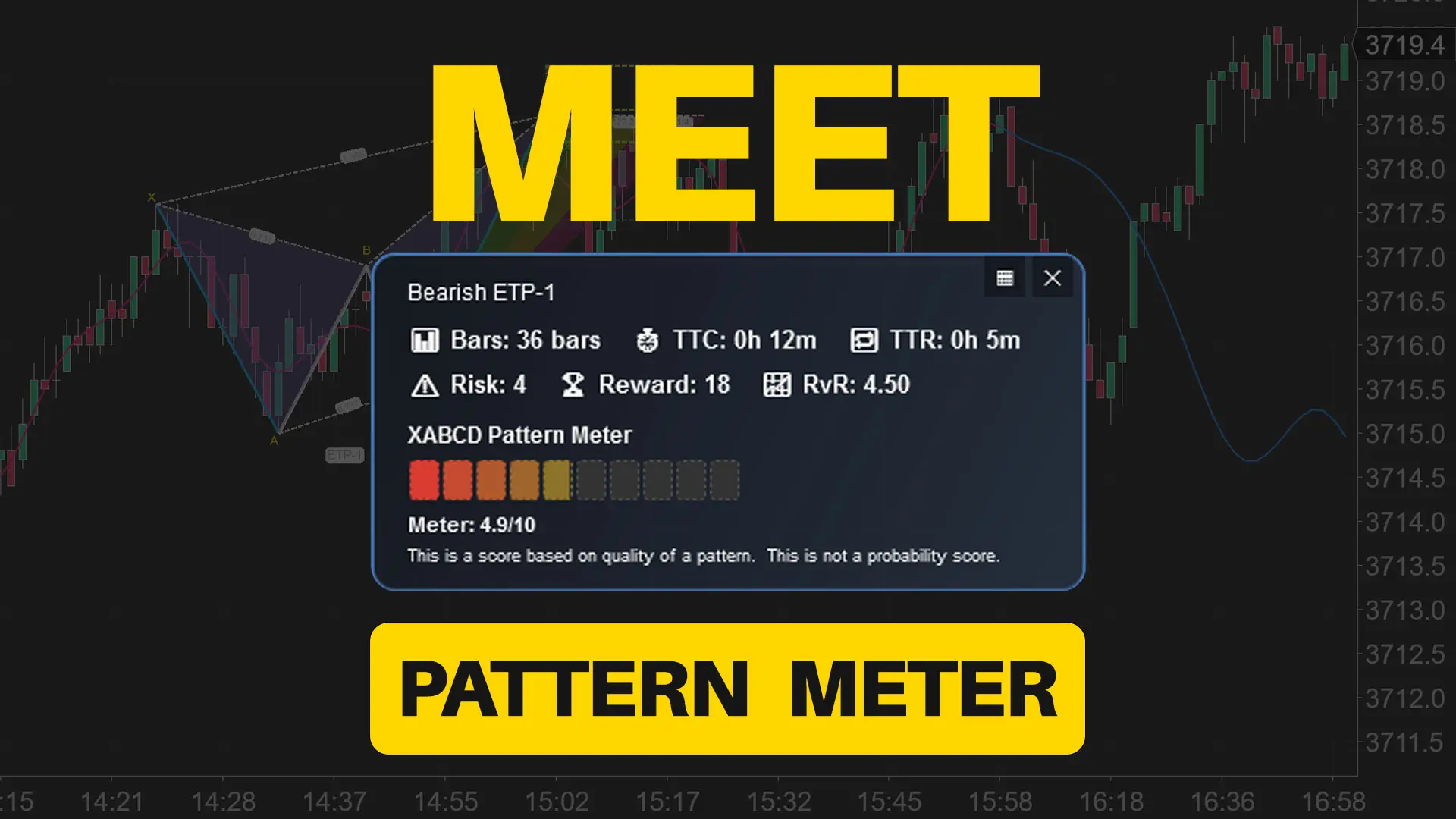

Meet the XABCD Pattern Meter (Real-Time Clarity)

XT PriceLine: Dynamic Colors That Let You See Every Tick

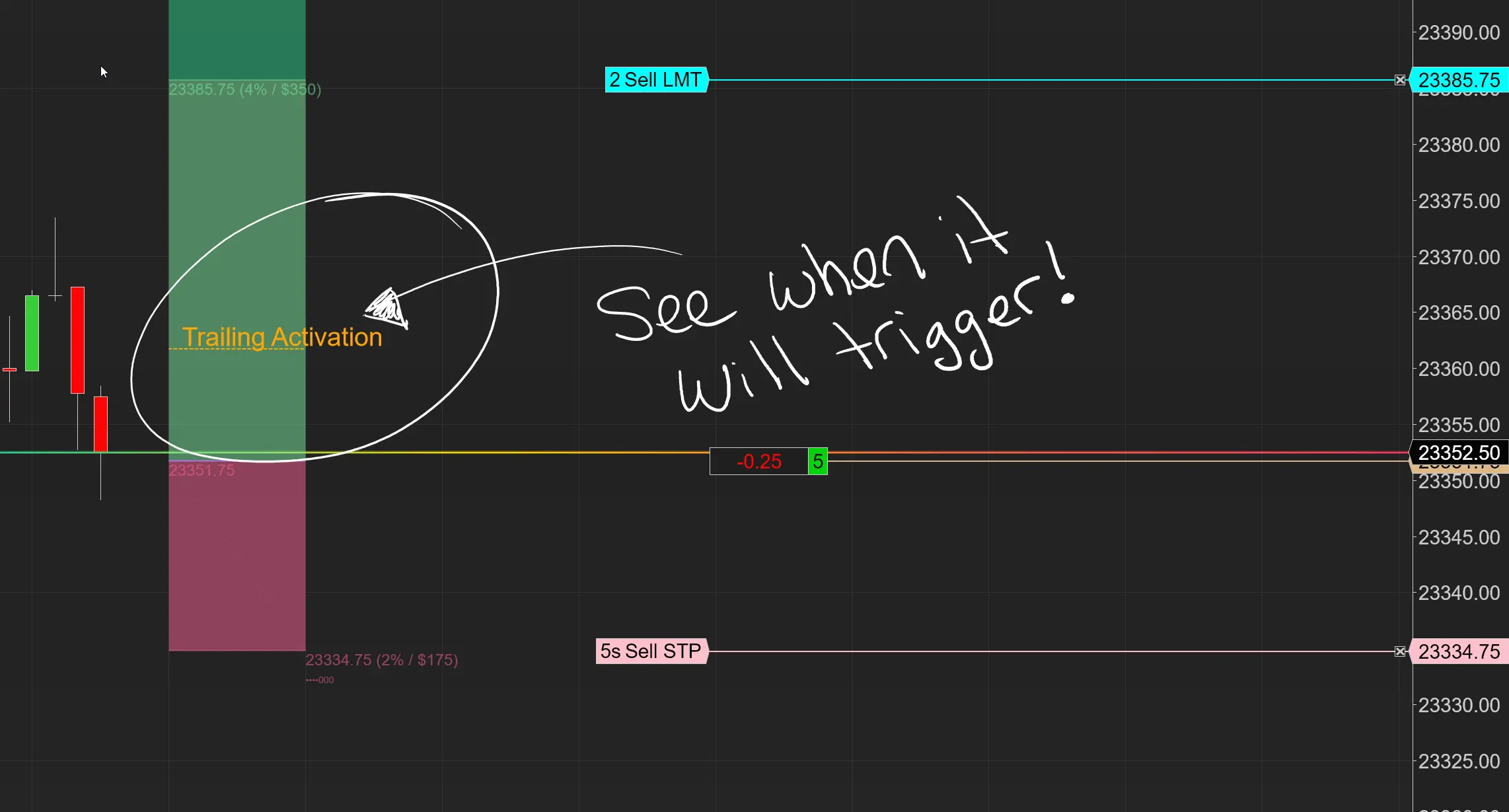

Dominate the Market with Smarter Trailing Stops in NinjaTrader

Why Risking A Percentage of Your Account is Critical When Trading XABCD Patterns

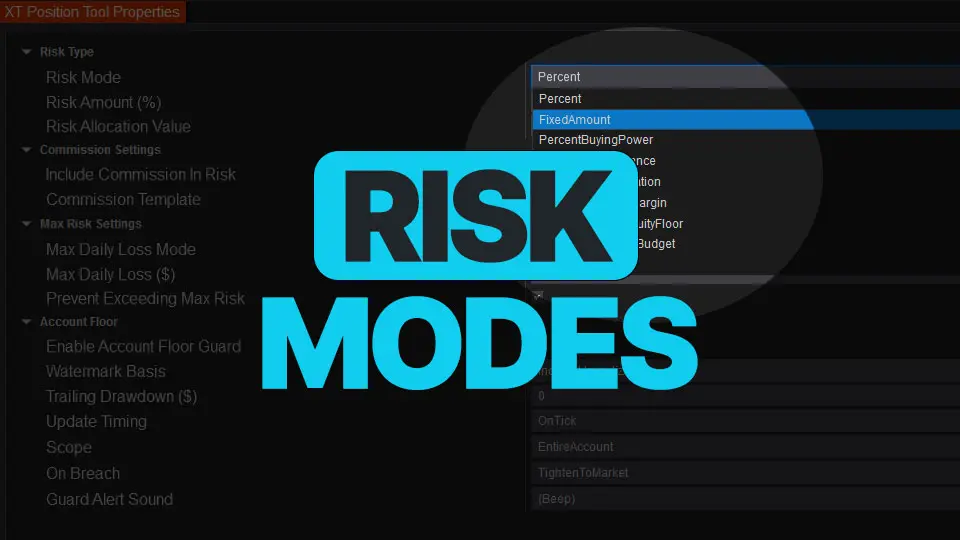

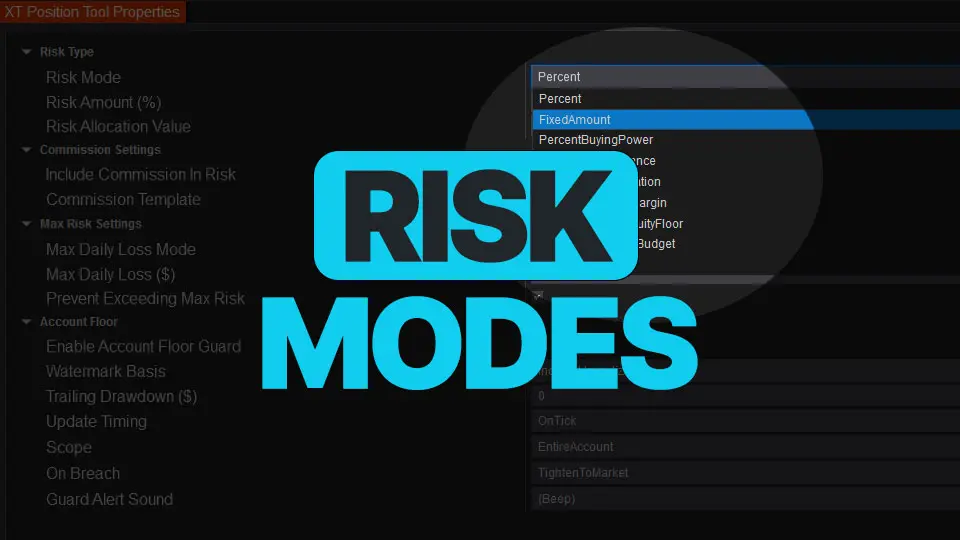

NinjaTrader Risk Management That Actually Moves the Needle

NinjaTrader 8.1.6 — The “No Fluff” Tour (Speed, Clarity, Fewer Clicks)

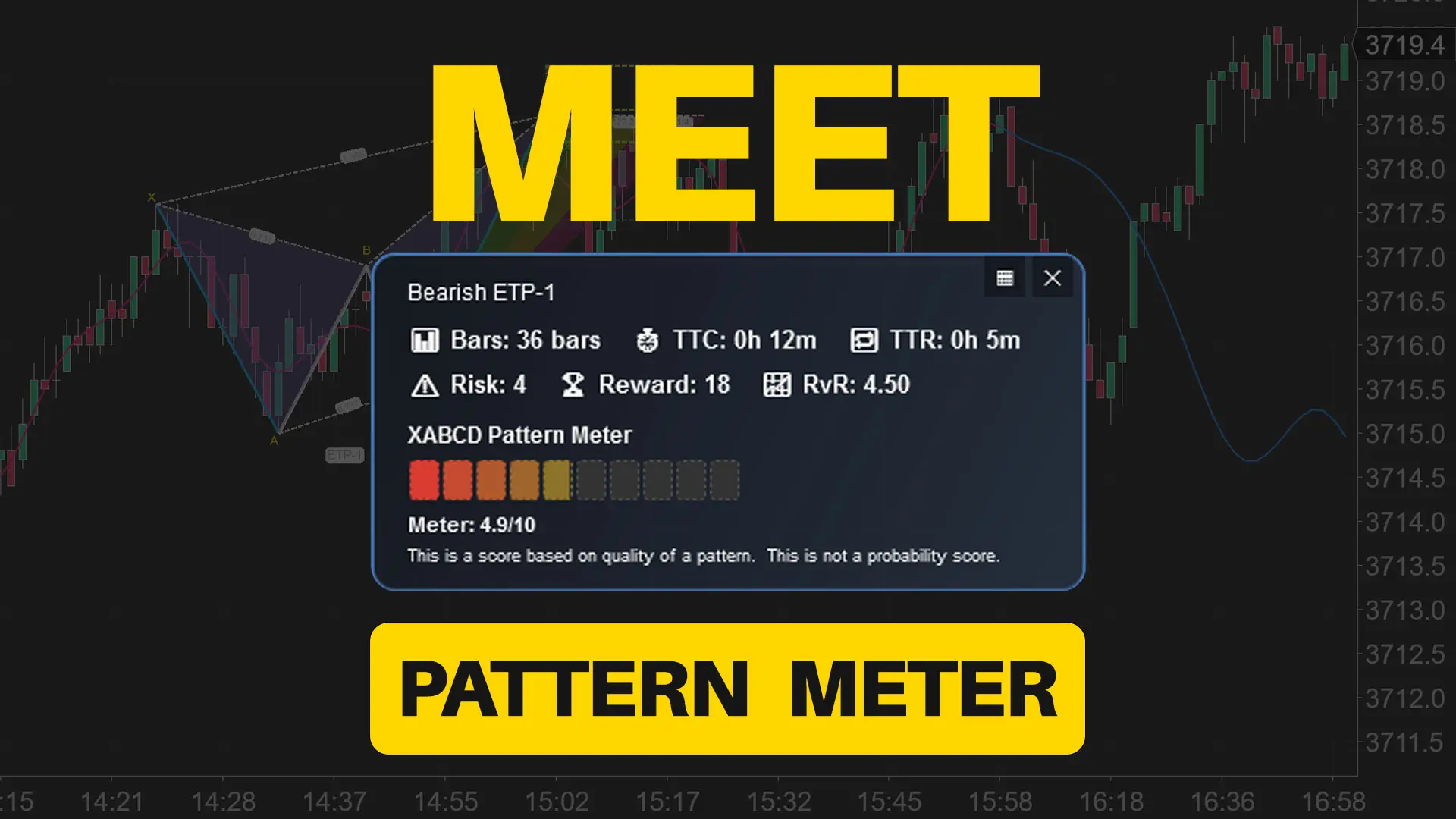

Meet the XABCD Pattern Meter (Real-Time Clarity)

XT PriceLine: Dynamic Colors That Let You See Every Tick

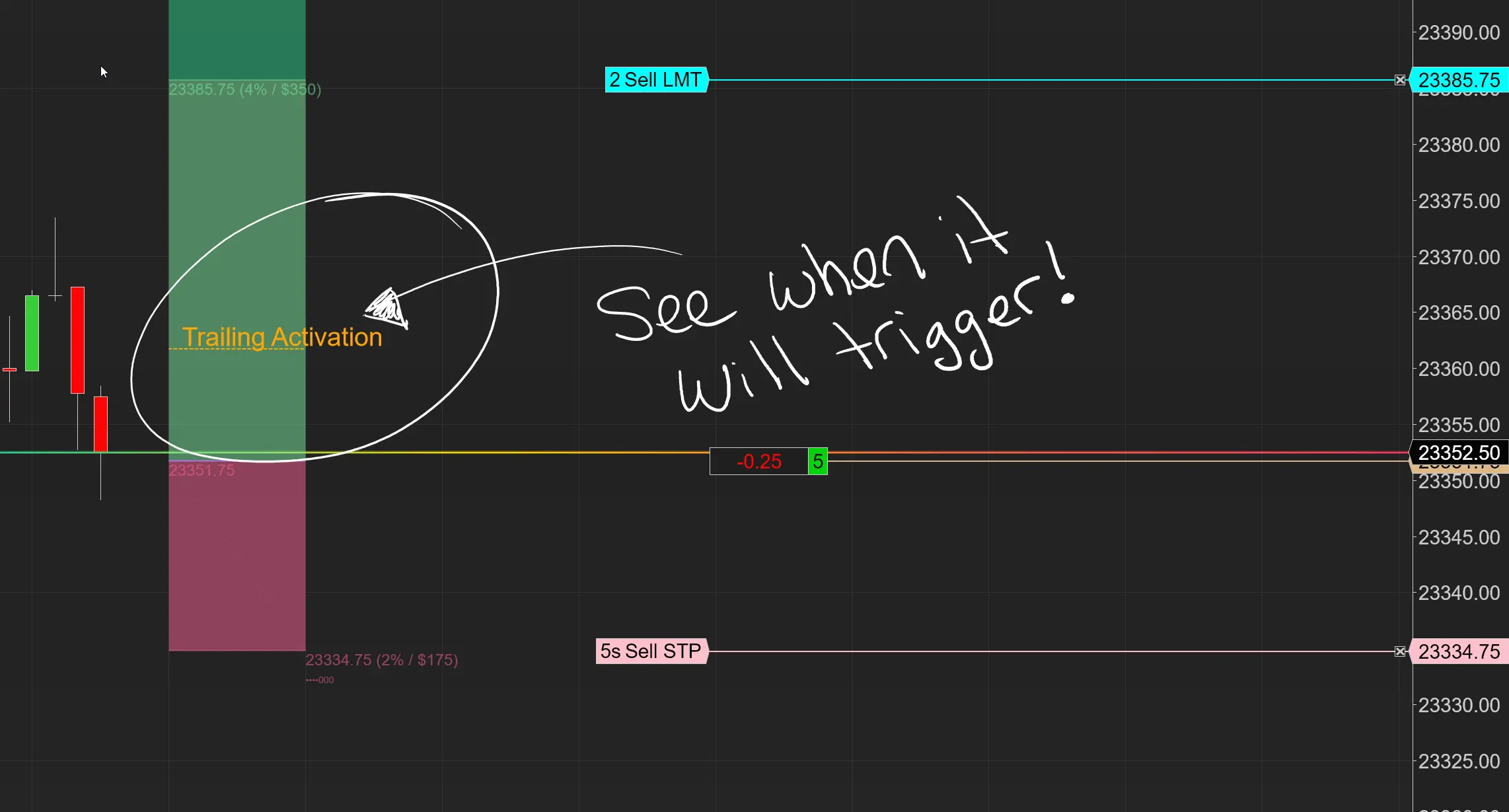

Dominate the Market with Smarter Trailing Stops in NinjaTrader

Why Risking A Percentage of Your Account is Critical When Trading XABCD Patterns

NinjaTrader 8.1.5 – They FINALLY Did It!

Best ATM Strategy for NinjaTrader 8

From Lag to Lightning: The Critical Role of Read/Write Speeds in NinjaTrader 8