A Scanner That Finds And Present You Opportunities

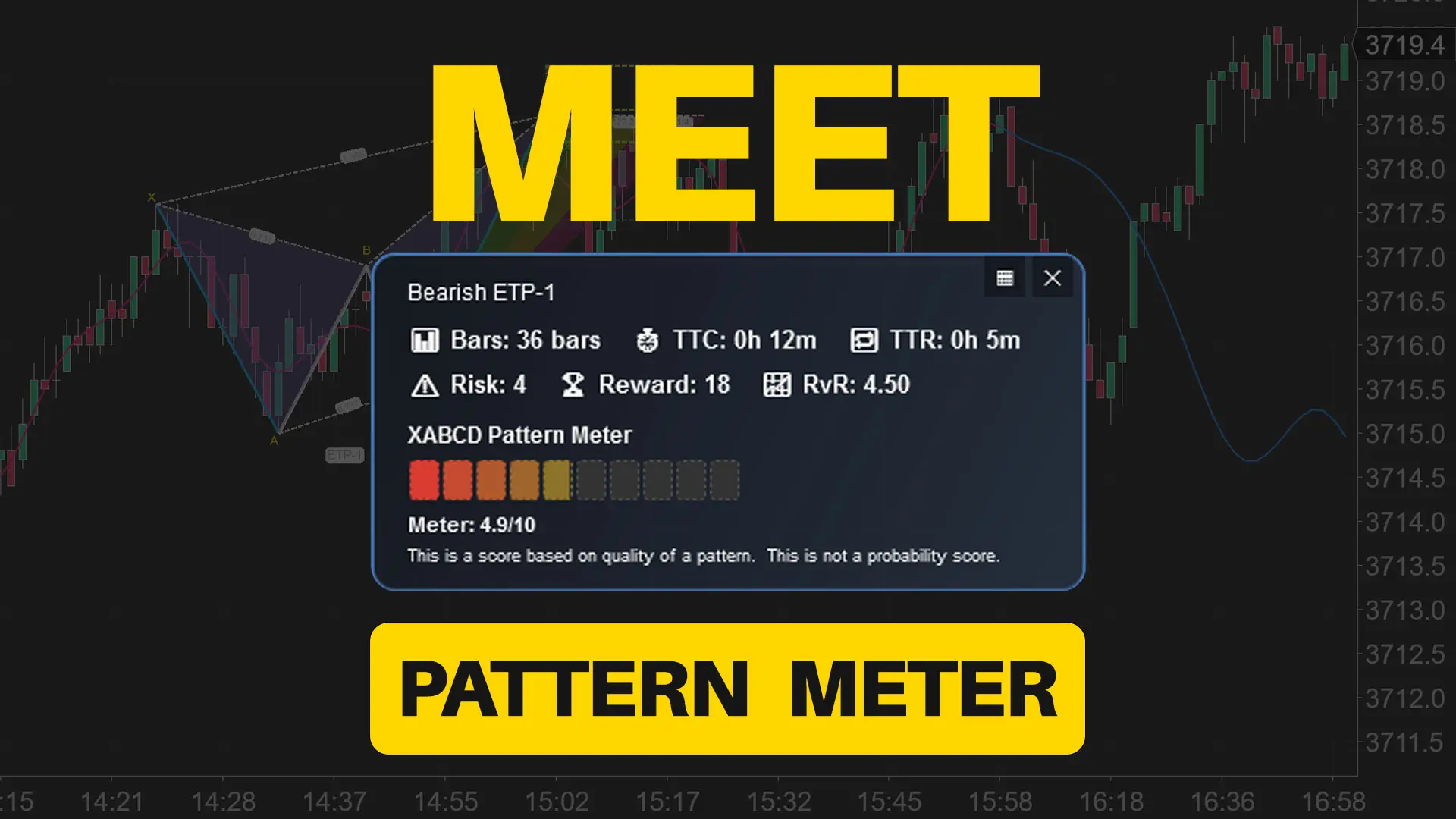

Option #1 - Ultimate Control and Freedom

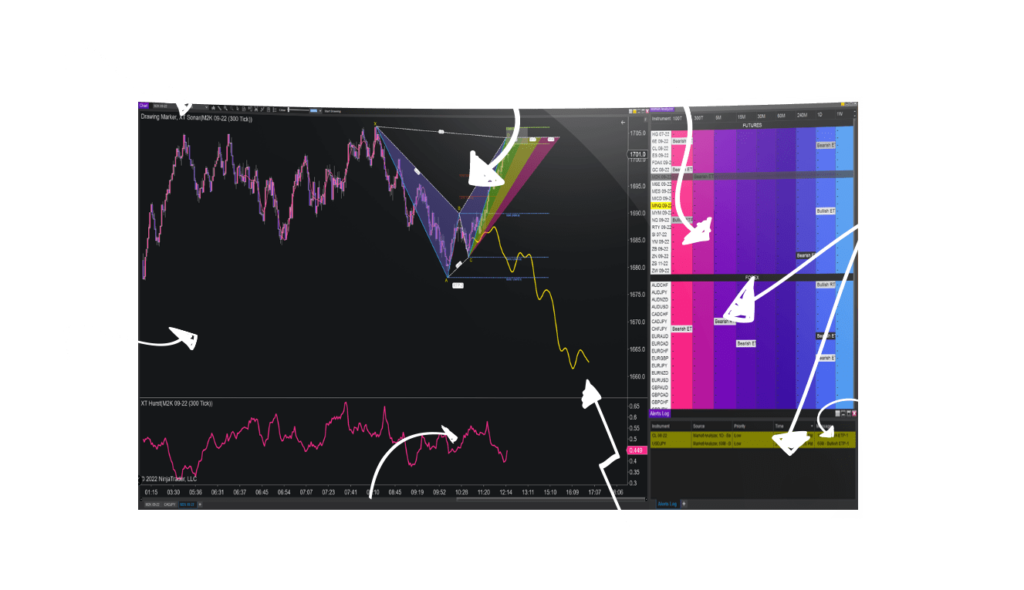

Our NinjaTrader Add-on for Scanning

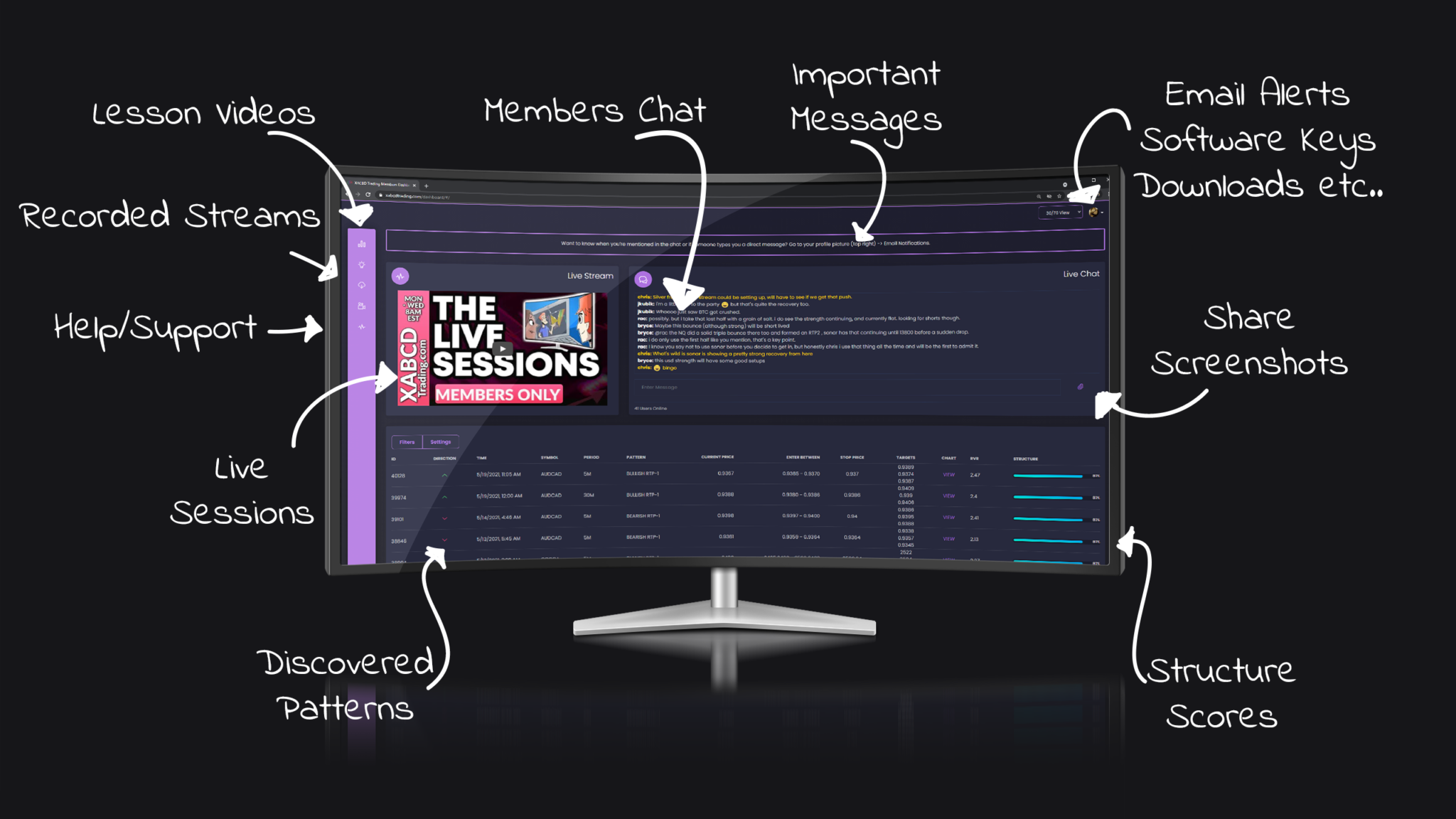

Web Based Scanning

Member Area Filters

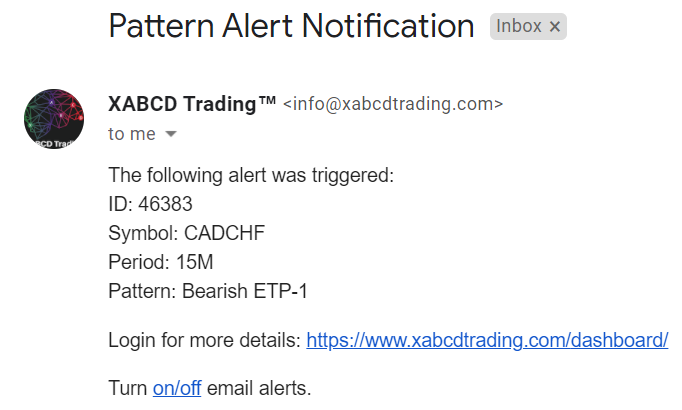

Email Notifications

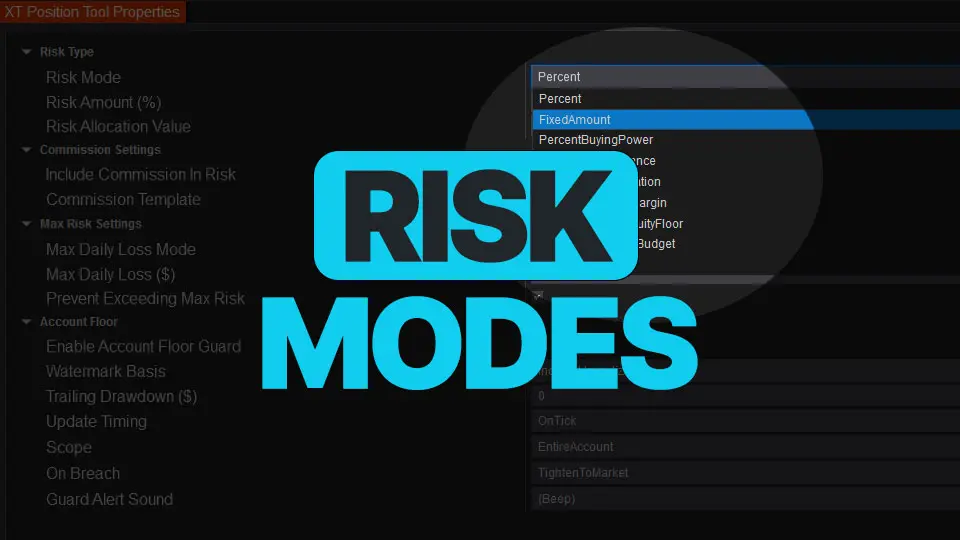

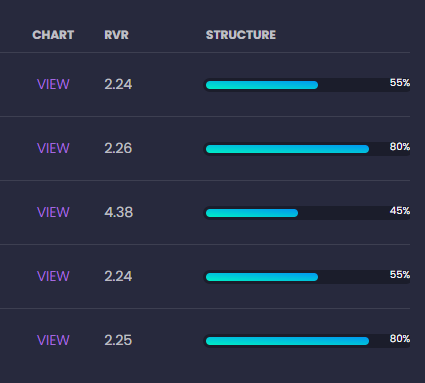

Structure Ratings to Further Filter XABCD Patterns

Average around 10-30 High Structure Ranking Patterns

We Do The Heavy Lifting

- How much room is there in the reversal area of the pattern?

The idea here is that if the pattern is expected to reverse on a time, chances are that isn't going to happen. Why not just remove those types of patterns from the ~1500 each day and look for patterns that allow more wiggle room. That's what we've done and is one of the conditions we look for with each pattern.

- How fast is the last leg of the pattern formed?

The last leg of the pattern and the emotional drive that happens to complete the pattern will give us an idea on how fast we would have to react to the pattern. The idea here is that everything has an equal and opposite reaction and that the angle of the last C-D leg would require you to make a decision quicker than what most people could even analyze a pattern. By removing these patterns you remove the patterns that might have already reversed or failed too quickly due to news events etc

- Need to filter based on time frame or symbols?

Yes this can be done too! If you only trade the 1 hour and certain symbols, you can set that up in the pattern filters too. Check the time frames you trade and the instruments and your all set!

- ... and many more conditions!

We don't publish everything detail we look for with the pattern for obvious reasons, but you will be taught in our education center most of the key things you will need to determine when trying to figure out the structure rating on your own by looking at a chart.