XABCD Trading

Calculate A Percentage of Risk Into a Position Size Automatically.

What Is It?

The position sizing tool is a highly effective means of managing risk for traders and investors. By utilizing a percentage-based approach, this tool can accurately calculate the optimal position size based on the desired level of risk.

Not only does this promote consistency in position sizing, but it also allows for scalability while staying within one's predetermined risk limitations.

Ultimately, incorporating a position sizing tool into your risk management strategy can help improve the overall effectiveness and success of your trading endeavors.

Who Wants This Tool?

So many differenet types of traders would find this useful. We get a lot of traders who are using it with evaluation or funded accounts. Also a lot of people that might manage money or want to keep a strict consistency with their own trading.

The position tool works in the following markets: Futures, Forex, Stocks, Crypto, Bonds.

How Does It Work?

1) First you will decide on your entry and stop, and use the position tool to mark that in.

2) The program will use your entry and stops to determine how much to risk in order to maintain your % of risk specified. It will figure out the position size based off a risk percentage.

2) The program will use your entry and stops to determine how much to risk in order to maintain your % of risk specified. It will figure out the position size based off a risk percentage.

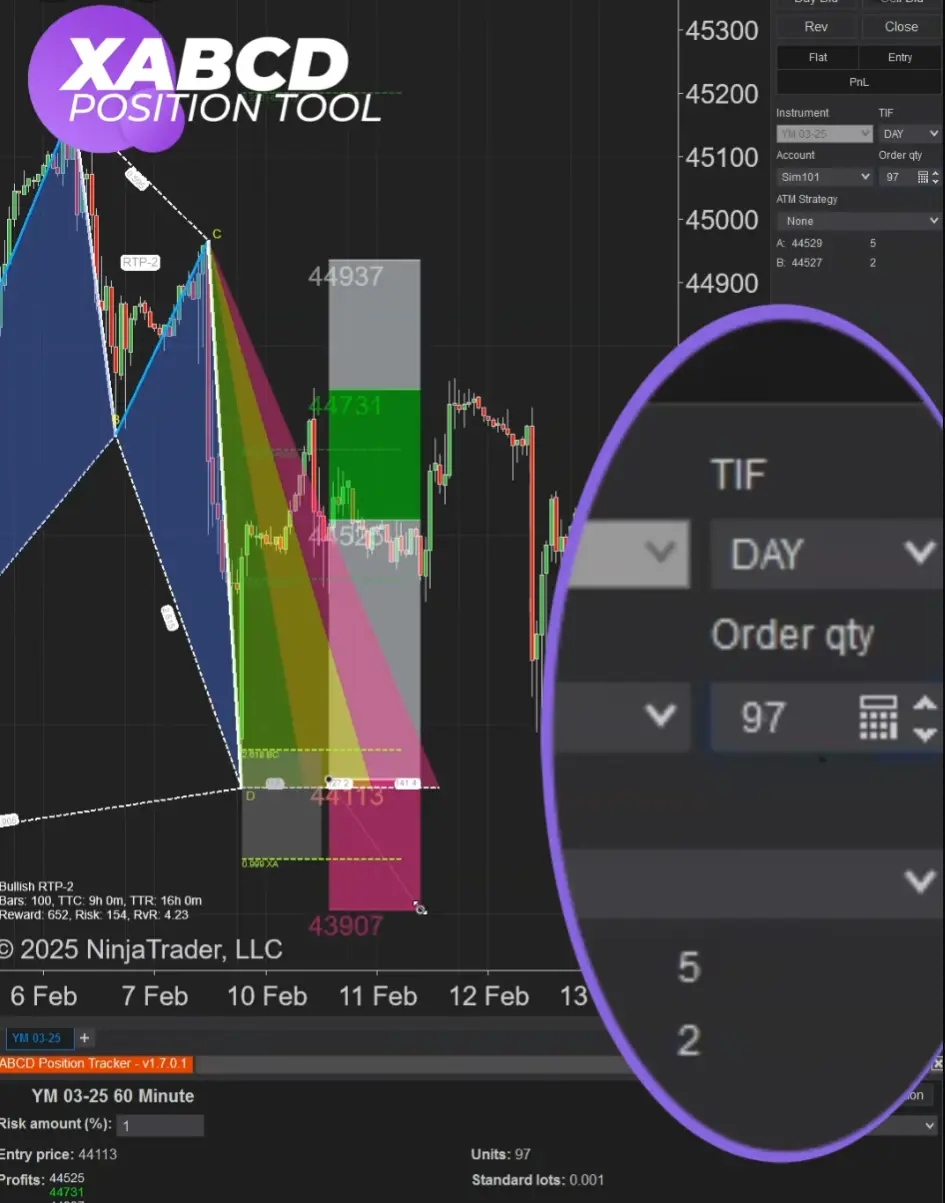

It automatically reads in your NinjaTrader account balance (live or demo) and can calculate even if you use an external account.

Example of Use

On-The-Fly Updates

Use it like a risk vs reward drawing tool, watch it auto calculate.

Step 1

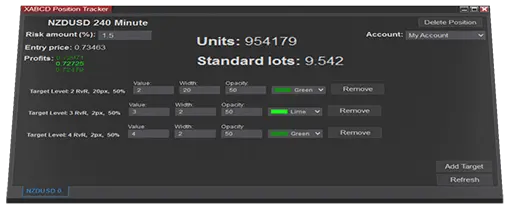

Set the percentage of risk per trade you wish to calculate, and the account you wish to use (live or demo).

Step 2

Click where you want the entry point, then select the stop and watch the target automatically draw based off your risk vs reward settings.

Done

In the tracker window, your can change the percentage of risk and you will see your calculation size appear.

Works On Live or Demo!

You can input your account balance of an external account into the NT8 software for the calculations or use a built in NinjaTrader account.

Live Account, Demo Account or Paper Trading - Works With It All. You don't need to have a NinjaTrader account to use this tool. You can use it with a demo account or if your just paper trading. We'll show you how to set this up...

How We Do The Calculation? We look at your account balance and the value of every tick/pip an compare that to the entry position you map out with your stop.

Does The Base Currency Of The Account Matter? We support any currency as the account and isn't just limited to US Dollars.

How We Do The Calculation? We look at your account balance and the value of every tick/pip an compare that to the entry position you map out with your stop.

Does The Base Currency Of The Account Matter? We support any currency as the account and isn't just limited to US Dollars.

Secure Your Copy

Support and Upgrades Included!

Get your life-time license for our position sizing tool in NinjaTrader 8 with one simple payment.

Why Use The Position Tool?

#1 Risk Management - It helps traders manage their risk effectively. By determining the position size as a percentage of your trading capital, you can limit the amount of capital you expose to any single trade. This reduces the risk of significant losses that could occur if you allocate too much of your capital to one trade.

#2Consistency - Position size calculators promote consistency in your trading approach. When you use a fixed percentage for position sizing, you ensure that you are not randomly allocating different amounts of capital to different trades. This consistency is crucial for maintaining a disciplined trading strategy.

#3Emotional Control - Trading can be emotionally challenging, and it's easy to let emotions like greed or fear drive your decision-making. A position size calculator removes some of this emotional influence by providing an objective, rule-based approach to determine how much to invest in each trade.

#4Capital Preservation - By limiting the percentage of your capital allocated to each trade, you protect your overall trading capital. Even if a trade goes against you, your losses are contained, allowing you to continue trading and potentially recover from losses in subsequent trades.

#5Adaptability - Position size calculators can be adjusted based on your risk tolerance and market conditions. If you become more risk-averse, you can lower the percentage allocated per trade. Conversely, if you become more confident or if market conditions change, you can adjust the percentage accordingly.

#6Portfolio Diversification - Using a percentage-based position size approach allows you to effectively diversify your trading portfolio. You can have multiple positions in different assets without overconcentrating your capital in a single trade.

#7Capital Growth - By managing risk and preserving capital, position sizing tools help traders stay in the game for the long term. Consistent, disciplined trading practices can contribute to the gradual growth of your trading capital over time.

Say Goodbye to Emotional Trading Decisions and Hello to Consistency and Discipline!

With this cutting-edge tool, you can confidently manage your risk and trade with more consistency in your risk management. It calculates your position size based on your risk tolerance, ensuring you never overexpose your capital.

$149

Promotional Price: $99